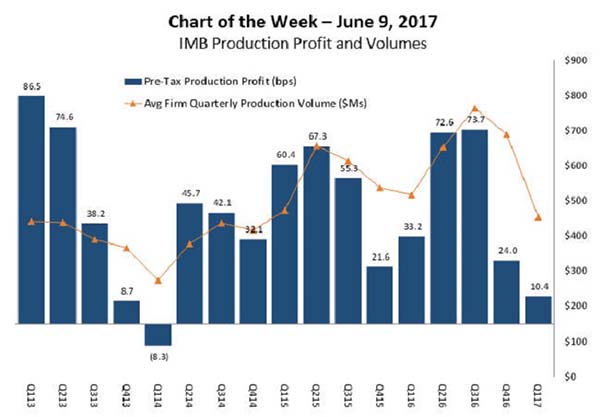

MBA Chart of the Week: IMB Production Profits, Volumes

Source: MBA Quarterly Mortgage Bankers Performance Report

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of 10.4 basis points ($224 on each loan they originated) in the first quarter, down from 24.0 basis points ($575 per loan) in the fourth quarter, according to the MBA’s Quarterly Mortgage Bankers Performance Report.

The drop in overall production volume in the first quarter resulted in the highest per-loan production expenses reported since inception of the report in third quarter 2008. Mortgage bankers saw their total loan production expenses increase to 384.5 bps ($8,887 per loan) in the first quarter, from 323.2 bps ($7,562 per loan) in the fourth quarter. A sharp reduction in refinance volume (due to rising interest rates) led overall production volume down.

Higher production revenues mitigated a portion of the cost increase. Total production revenue increased to 394.9 basis points ($9,111 per loan) in the first quarter, from 347.3 bps ($8,137 per loan) in the fourth quarter. For those mortgage bankers holding mortgage servicing rights, an increase in mortgage interest rates resulted in MSR valuation gains and helped overall profitability.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is research analyst with MBA; she can be reached at jmasoud@mba.org.)