Deregulation: An Innovation Damper for a New Year?

(Mark Dangelo is president of MPD Organizations LLC, featuring books, industry reports and articles. He is a strategic management consultant, outsourcing advisor and analytics specialist with extensive process, technology and financial results and is a frequent contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.)

To quote Bachman-Turner Overdrive, “You ain’t seen nothing yet” when it comes to what will likely happen with rollbacks to the post-Great Recession regulations years in making.

With the president-elect hinting regarding a reinstatement of some type of new-age Glass-Steagall Act to a repeal of numerous provisions within Dodd-Frank to defanging the Consumer Financial Protection Bureau to simply just not enforcing what many within the industry deem government overreach, the likelihood that regulatory compliance costs and efforts will decrease has helped push the S&P banking index up by nearly 30 percent in under two months. It seems that bankers will have much to celebrate in 2017–assuming the chaotic world of cross-market risks don’t somehow change the unproven, euphoric math.

Contrary to post-recessionary consumer demands, the largest five banks now control more than 45 percent of global assets (a threefold increase in eight years), fintech firms are applying for banking charters and consumers have even more methods to connect, pay for and manage their lives than in recorded history–all at their mobile fingertips. Much has happened to move the needles of what banking and finance must provide in just seven years.

Yes, we can compare the positive and negatives of the aforementioned–painting a story of the preferred outcomes that aligns with our core principles and communicated beliefs. So regardless of one’s position, we can recognize that whatever our situation, all delivery segments have been aided or spearheaded by burgeoning necessity and layers of innovation. There has been, as Napoleon once said, “a foot on fire” driving stoic organizational cultures to accept new realities that run counter to ingrained traditional beliefs due to new and pervasive regulations. Regulation has indeed been a double-edged sword, cutting profitability but also improving risk and soundness.

So as regulations (or shackles) are set to be removed, we need to prepare for the flipside of their removal. With conservative estimates putting repeal of cross-industry regulations in the hundreds, will the push of technology to advance many borrower and consumer practices (intended to adapt to rapidly transforming customer experiences) be pushed off? If the direct or indirect drivers of change are removed, will the innovative data stimulus also wane in favor of traditional approaches more comfortable for bankers? And finally, without a sense of urgency and competitive confrontations across and within financial channels and consumer demographics, will traditional bank thinking once again become status quo merely augmented by creeping innovation?

What we have truly experienced since 2011 are subtle and aggressive disintermediation’s likely precipitated by the yin-and-yang of regulatory compliance. The desire to reduce time and people necessary to efficiently collapse channels requested by consumers has likely benefited from regulatory guidance, which is increasingly being satisfied by rapidly emerging technology, data and process reengineering.

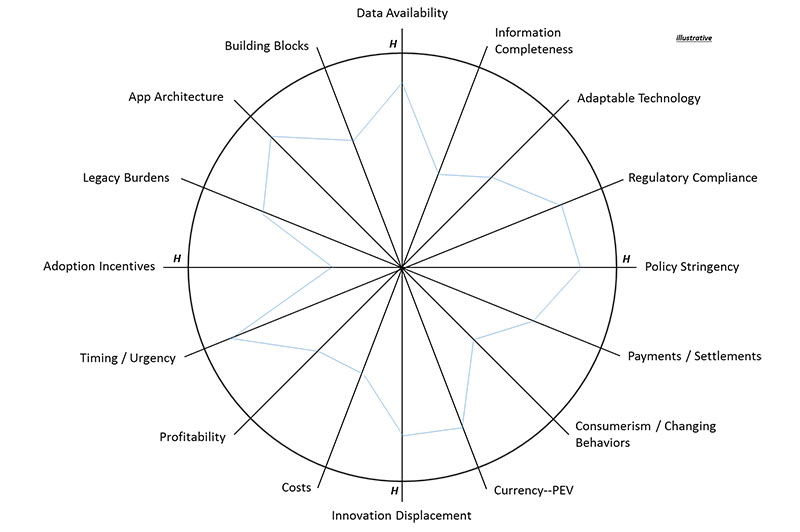

Moreover, when looking at the effects regulations can have or organizations, we note that there are at least 16 areas directly and indirectly impacted by their existence or removal. Several of these impact areas have strong ties to disintermediation trends–payments, market provisioning, lending, funding and contact–all which are wrapped around critically important envelopes of security, privacy, risks and disclosure. As noted in the illustrative figure below, each impact area can be ranked (before and after regulatory issuance) to establish markers for what happens when or if the expected wave of repeals is issued by Congress or executive orders (including the forthcoming implementation or delay of the Volker Rule).

Whereas it is a reality that regulatory compliance has triggered widespread innovation displacement (i.e., traditional advancements forced out by cross-industry behaviors), it also harbors future disintermediation events that are not even being contemplated as the cycle of disintermediation moves from a perceived one-off event to that of continuous disruption brought forth by cross-market urgency, new uses of data and multiple adaptable technologies.

–Removal of Urgency: Banking and its bankers have been their own worst enemy when it came to defending themselves against overreach. It was a problem rooted within corporate culture and internal politics–something that has been changing due to mandated regulations, stress testing, living wills and a host of federal, state and local guidance. Yet, there has been positive mergers and acquisitions (the highest in a decade), profitability has been restored along with consumer confidence and the pace of technology change is robust. What will the plans for 2017-2018 look like when the impetus for change is gone? Will politics and dogma once again force a future cataclysm?

–Reduction of Data Forces: The timing couldn’t have been worse. Just as financial services organizations and operations perished under bad loans, exotic instruments and a host of assets not properly risk attributed brought down many enterprises, the exponential explosion in the volume of data overwhelmed the remaining crippled operations. With the flood of data sources–social, retail, financial, professional, personal and mobile–the potential to create maps of behaviors, forecasts of consumption and bottom-line profitability when properly integrated provided insights and bespoke products and services deemed before the crisis as a technological dream.

Yet, data integration brought forth by the demands of complex regulations has provided a foundation for new banking architectures and offerings that will likely force into retirement traditional front, middle and back office systems. So if the removal of regulations usher in a decline of complex, multi-faceted data analytics and taxonomies, what will happen to the expertise honed and advanced reluctantly assembled? Will the innovations being made be slowed in favor of “business as usual?”

–Failure to Apply Adaptable Technology: The most popular topic of the press and within enterprises involves block-chain and its cousin distributed ledger. Yet, there are also advanced technologies that have expanded greatly in the past five years including artificial intelligence/predictability, cloud provisioning, “robot” advisory solutions, machine learning and biometric security to meet regulations, while streamlining complexity and costs.

Moreover, additional adaptive technologies include intelligent apps, “Internet of Things” linkages, virtualization of solutions and platforms, mobile applications, comprehensive digitization and service based architectures. Many of these advancements have come at a time of burdensome regulation. While I am not making a proclamation that these advancements came directly as a result of regulation, they were likely advanced to their adaptable states by the need to satisfy complex and in some cases, cross-purpose oversight. So what will transpire when the burden is gone? With the strides made subside or disappear as investment wanes and fragmentation resurfaces?

Regulation is indeed a double-edge sword. In a highly regulated industry such as financial services, it is very tempting to jettison the new especially if it comes with an association of heavy regulatory burdens. It seems many institutions are already booking results and readying rollbacks even before Q1 2017 has run its course–it might be a mistake. Unwinding far-reaching regulatory demands will indeed result in a short-term bump regarding profits, discretionary budgets, litigation and available hours.

But regulations of the past decade have been huge and complex and the lost momentum, risk-mitigation and cross-purpose improvements that were to be gained from their streamlining, might also deduct from the upside of their removal. As we know, the financial services supply chain is multifaceted, layered, compartmentalized and globally connected–make one change in an area and we cannot reliably predict what the up or downstream impacts might be within a dynamically expanding environment.

In closing, let us not forget how we got to the state we are in today. While a party to celebrate a reduction in regulation might feel very good to the corporate soul, it might be a lost opportunity to transform and further disintermediate what we already have arrived at. The baby and bath water analogy comes to mind.

(Views expressed in this article do not necessarily reflect the views or policies of the Mortgage Bankers Association. MBA NewsLink welcomes your contributions; articles or inquiries should be submitted to Mike Sorohan, editor, at msorohan@mortgagebankers.org.)