Explore how MISMO is driving innovation through industrywide data standards. Discover the tools, resources, and initiatives that are shaping the future of mortgage finance—and how you can get involved.

Category: News and Trends

Advocacy Update: MBA-Supported VA Partial Claims Bill Heads to President Trump for Enactment

This week’s top legislative and policy news from the Mortgage Bankers Association.

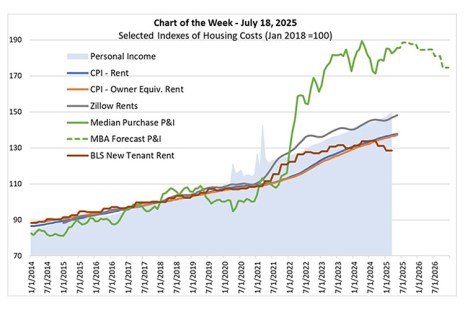

Chart of the Week: Selected Indexes of Housing Costs

MBA forecasts that house price appreciation will continue to moderate in the coming quarters.

Optimizing Mortgage Servicing: How Lenders Can Adapt to a Digital-First Landscape

Dovenmuehle’s Anna Krogh says borrowers expect the same convenience, speed and transparency from their mortgage servicer that they experience with their digital banking, retail and streaming experiences.

Single-Family Housing Starts Dip; Multifamily Starts Jump

Housing starts ticked upward in June, driven by a sharp jump in multifamily starts as single-family starts fell compared to May.

MBA NewsLink Quote of the Day

“Single-family permits sagged for the fourth consecutive month as builders pull back amid mounting challenges, including ongoing affordability issues, rising material costs and tariff-related uncertainties, elevated new-home supply, and growing competition from the resale market.”

–First American Deputy Chief Economist Odeta Kushi

MBA: June New Home Purchase Mortgage Applications Increased 8.5%

MBA’s Builder Application Survey data for June 2025 shows mortgage applications for new home purchases increased 8.5% compared to a year ago. Compared to May 2025, applications decreased by 4%.

MISMO Publishes Updated eVault Standards and SMART Doc Validation Rules

MISMO, the real estate finance industry’s standards organization, published revisions to the eVault Standards and SMART Doc Validation Rules. This standard increases interoperability and trust between partners trading eNotes.

Premier Member Editorial: How Data-Driven Strategies Help Lenders Expand Access, Better Manage Risk

Maintaining a competitive edge requires lenders to be proactive in using data-driven insights to make faster and more informed decisions, Wendy Hannah-Olson from Equifax writes.

Redfin: Almost One-Quarter of Young Buyers Used Gift or Inheritance in Down Payment

Redfin, Seattle, released a new study finding that 23.8% of Gen Z or millennials who recently bought a home used some form of family money to help fund their down payment.