The MBA Mortgage Action Alliance holds its next Quarterly Webinar on Wednesday, May 11 from 2:00-3:00 p.m. ET. The MAA Quarterly Webinar will provide MAA members (and prospective MAA members) …

Category: News and Trends

MBA Weekly Applications Survey May 4, 2022: Applications Increase

Mortgage applications increased 2.5 percent from one week earlier, according the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending April 29.

Roby Robertson of LoanLogics: Ignoring Income Defects Could Spell Disaster

Back in 2015, Tesla CEO Elon Musk famously promised that self-driving cars would be a common sight on American roadways within the next three years. He wasn’t alone—Nissan and other automakers thought fully autonomous vehicles would arrive by 2020.

Souren Sarkar, CMB, of Nexval: How Robotic Process Automation Creates More Efficient Lending

RPA technologies have been proven to shrink loan origination and processing times by as much as 80% while increasing post-close quality control efficiencies by as much as 20%. More importantly, they empower lenders to free up resources to deliver better customer service to borrowers. And yet, there is relatively little discussion or understanding about how RPA actually works—let alone how powerful it can be.

FHFA Announces Mandatory Supplemental Consumer Information Form Use

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will require lenders to use the Supplemental Consumer Information Form as part of the application process for loans that will be sold to the Enterprises.

News Briefs From ATTOM, First American Financial Corp.

ATTOM, Irvine, Calif., launched the ATTOM Rental AVM (Automated Valuation Model). The new software, built from the foundation of the company’s nationwide property database, provides rent estimates for more than 72 million single-family residences nationwide.

Grandbridge’s Marcy Thomas Talks CMBS, DEI and CCMS

MBA NewsLink interviewed Marcy Thomas, Vice President and Portfolio Loan Manager with Grandbridge Real Estate Capital LLC, about CMBS servicing, DEI, the upcoming Commercial/Multifamily Finance Servicing and Technology Conference and what the CCMS designation means to her.

MBA Single-Family Research and Economics Showcase June 22-23

The Mortgage Bankers Association’s Single-Family Research and Economics Showcase takes place online June 22-23.

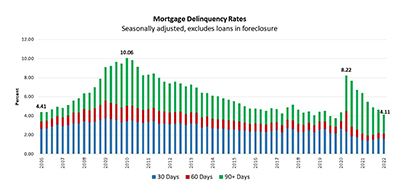

MBA: Mortgage Delinquencies Decrease in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.11 percent of all loans outstanding at the first quarter’s close, the Mortgage Bankers Association’s National Delinquency Survey reported.

Quote

“The mortgage delinquency rate dropped for the seventh consecutive quarter, reaching its lowest level since the fourth quarter of 2019. The decrease in delinquency rates was apparent across all loan types, and especially for FHA loans.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.