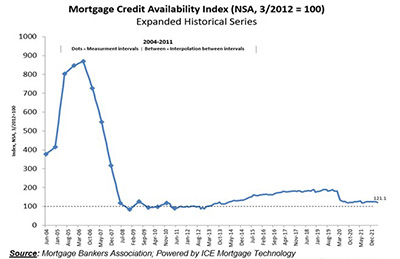

Mortgage credit availability fell in April, the second straight monthly decrease, the Mortgage Bankers Association reported Tuesday.

Category: News and Trends

Quote

“The increase in mortgage applications last week was driven by a strong gain in application activity for conventional and government purchase loans, even as mortgage rates rose to their highest level – 5.53 percent – since 2009.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Tony Thompson, CMB: CCL Coaching Program Launches at NAMMBA

The secret to success in the CRA/LMI marketplace isn’t a formula. It isn’t banging your head on the proverbial brick wall hoping for a breakthrough. And it isn’t trying the same old tactics in the hope that something sticks. It’s a combination of knowledge and becoming a part of the community you serve.

MAA Action Week May 9-13

The Mortgage Action Alliance’s Action Week is a national, industry-wide campaign dedicated to helping real estate finance professionals learn how to become more engaged in political advocacy that supports our industry.

Mark P. Dangelo: The Digital ‘Butterfly Effect’ — Defining the Consumer and Their Options

As economic and political impacts shift in 2022, underpinning it all is a silent reality crater exposing audit and systemic risks as digital transformations continuously evolve.

Q/A: Marcy Thomas, CCMS, of Grandbridge Real Estate Capital

MBA NewsLink interviewed Marcy Thomas, Vice President and Portfolio Loan Manager with Grandbridge Real Estate Capital LLC, about CMBS servicing, DEI, the upcoming Commercial/Multifamily Finance Servicing and Technology Conference and what the CCMS designation means to her.

MBA Education, Superus Careers Partner on Mortgage Career Exchange Marketplace

MBA Education, the career advancement arm of the Mortgage Bankers Association, and Superus Careers, a U.S.-based employment recruiting firm, announced a partnership for mortgage professionals to maximize their employment options.

April Mortgage Credit Availability Slips

Mortgage credit availability fell in April, the second straight monthly decrease, the Mortgage Bankers Association reported Tuesday.

To the Point with Bob: How Policymakers Can Empower Mortgage Lenders To Deliver More Relief To Borrowers

A debate broke out last week among industry commentators about the meaning and importance of mortgage lender margins during the COVID-19 pandemic. The conversation matters because it could impact the policies that govern the industry and affect people’s ability to obtain affordable mortgage loans and pursue the American Dream.

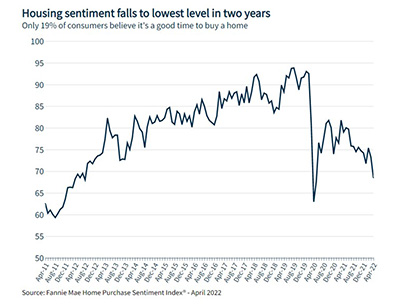

Fannie Mae: Consumer Sentiment Toward Housing Falls to 2-Year Low

The Fannie Mae Home Purchase Sentiment Index fell by 4.7 points to 68.5 in April, its lowest level since May 2020, as surveyed consumers expressed heightened concerns about housing affordability and rising mortgage rates.