LenderLogix, Buffalo, N.Y., released its Homebuyer Intelligence Report, finding that in the second quarter, pre-approval letters generated via LenderLogix’s software rose by 11.9% from Q1 and the average pre-approval loan amount increased to $367,305.

Category: News and Trends

Time to Retire the Franken-Stack

LenderLogix CEO Patrick O’Brien says the “Franken-stack” is quietly draining time, patience and profit from lending operations in ways that are hard to ignore.

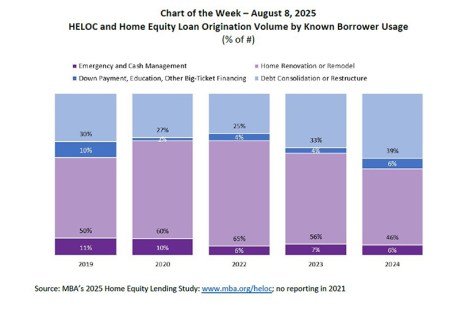

Chart of the Week: HELOC and Home Equity Loan Origination Volume by Known Borrower Usage

MBA recently completed its 2025 Home Equity Lending Study, tracking trends in origination and servicing for home equity lines of credit (HELOCs) and home equity loans.

Dealmaker: Peachtree Group Originates $42M for Acquisition, Repositioning of Atlanta Financial Center

Peachtree Group, Atlanta, originated a $42 million first mortgage loan to finance Banyan Street Capital’s acquisition and repositioning of the Atlanta Financial Center.

Be Inspired. Be Informed. Be mPowered!

MBA is proud to offer mPower, MBA Promoting Opportunities for Women to Extend their Reach, the largest networking organization for women in real estate finance.

Fannie Mae Sentiment Index Up Two Points in July

Fannie Mae released its latest Home Price Sentiment Index, which increased to 71.8 in July.

Residential Certified Mortgage Servicer (RCMS) Designation

Designed to carry you through the process of onboarding through career advancement and setting yourself apart, the Residential Certified Mortgage Servicer (RCMS) Certificate and Designation program is a comprehensive program comprised of three levels.

Milliman: Mortgage Default Risk Inches Up

Milliman, Seattle, found a slight increase in the lifetime serious delinquency rate (for homes 180-plus days delinquent) for U.S.-backed mortgages.

Premier Member Editorial: Why Closing Protection Letters Are Insufficient for Risk Management

Secure Insight President and CEO Andrew Liput writes that closing protection letter offers limited protection to banks and borrowers in real estate closings.

Power Up Your Mortgage Marketing [Sponsored by MeridianLink]

With shifting economic signals and the Rocket-Redfin merger shaking up homebuying, how can lenders attract more borrowers today?