The Mortgage Bankers Association’s annual CREF Market Intelligence Symposium takes place June 15-16.

Category: News and Trends

MBA Home For All Pledge Partner: CoreLogic

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

Quote

“Home price trends in Opportunity Zones mirror what we’re seeing elsewhere in the housing market. Strong price growth has helped homeowners in these economically challenged areas benefit from higher equity, and should contribute to the ongoing redevelopment of these areas.”

–Rick Sharga, Executive Vice President of Market Intelligence at ATTOM.

MBA Weekly Survey June 1, 2022: Applications at 4-Year Low

Mortgage applications fell for the third straight week to their lowest level since 2018, despite interest rates falling for the fourth time in five weeks, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 27.

Patrick Gluesing: After Rapids of Refinance, Quality Mortgages Calm the Waters

For the past two years, as rates plummeted to historical lows—due largely to outside factors—originators and servicers have enjoyed the rushing rapids of origination volume. Now that rates are rising and refi volumes have slowed, organizations need to find other areas of growth, such as non-QM loans and mortgage servicing rights.

MBA CONVERGENCE Partner Profile: Dan Ticona of Freddie Mac

Dan Ticona leads the Housing Solutions team within the Single-Family Client and Community Engagement division at Freddie Mac, McLean, Va., focused on developing innovative solutions to reduce barriers to homeownership.

MISMO Spring Summit in Charleston June 6-9

The MISMO Spring Summit takes place June 6-9 in Charleston, S.C.

MBA Weekly Survey June 1, 2022: Applications at 4-Year Low

Mortgage applications fell for the third straight week to their lowest level since 2018, despite interest rates falling for the fourth time in five weeks, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 27.

CBRE: Hotel Market Sees 2023 Full Recovery

CBRE, Dallas, raised its hotel performance forecast based on first-quarter strength, slow construction activity, higher inflation and continued optimism about employment and economic growth.

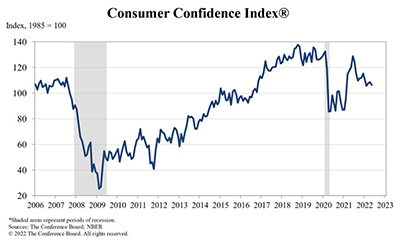

Inflation, Rising Interest Rates Cool Consumer Confidence

The Conference Board, New York, said its Consumer Confidence Index decreased slightly in May, following a small increase in April.