The Mortgage Bankers Association selected Philadelphia as the site for its next CONVERGENCE initiative, a place-based partnership focused on narrowing the racial homeownership gap. CONVERGENCE Philadelphia will launch in early 2023, joining CONVERGENCE initiatives in Memphis, Tenn., and Columbus, Ohio.

Category: News and Trends

MBA Advocacy Update Tuesday June 21, 2022

On Wednesday, FHFA published its 2021 Annual Report to Congress, which provides details on the Agency’s activities over the course of the past year, including its actions as conservator of Fannie Mae and Freddie Mac.

The Week Ahead, June 21, 2022: MBA Spring Meetings Conclude; Mr. Powell Goes to Capitol Hill; and 3 Other Things to Know

Good morning and happy Tuesday! We hope you had a safe and happy Juneteenth holiday. Now, let’s talk about what’s happening this week:

Private Investors Look To Retail Sector

Private investors are acquiring larger and more expensive retail assets as the sector’s recovery continues.

Dealmaker: Sonnenblick-Eichner Secures $35M for Oakland Hotel

Sonnenblick-Eichner Co., Beverly Hills, Calif., placed $35 million for the leasehold interest in the Moxy Oakland Downtown, a 172-room hotel in Oakland’s Uptown Arts and Entertainment District.

Sponsored Content from SWBC: 2022 Property Appraisal Challenges; an Interview with Chuck Mureddu

Mortgage lenders are having a hard time sourcing affordable, prompt property appraisals. We discuss this challenge with SWBC’s Chief Valuation Officer, Chuck Mureddu.

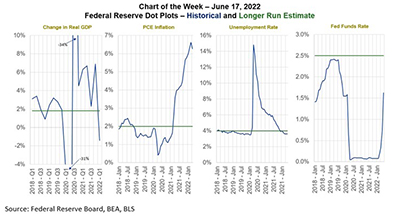

MBA Chart of the Week June 17 2022: Federal Reserve Projections

The Federal Reserve is racing to catch up to economic events, announcing a 75-basis-point increase in the federal funds rate and signaling more increases following last week’s FOMC meeting.

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

The MBA Home for All Pledge

The MBA Home for All Pledge represents our industry’s long-term commitment on a sustained and holistic approach to address racial inequities in housing.

MBA, Winnow Solutions LLC Partner to Help Members with Compliance Research, Costs

The Mortgage Bankers Association and Winnow Solutions LLC, Anaheim, Calif., announced a partnership that will provide MBA member subscribers – at a 10% discount rate – a comprehensive database of state and federal regulations to help control costs and better manage the growing complexity of mortgage regulations.