To many mortgage business owners, the cost of employees can be a significant portion of their business budget. It can also make a significant impact on the success or failure of their business. It’s in this area that experts within the mortgage industry can help you make better decisions by providing you with expertise and services that can streamline your financial management.

Category: News and Trends

Aaron Davis and Jonathan Kearns: Making the Case for Universal eClosings

They’re now legal almost nationwide and they were boosted by the pandemic. But they’re still not the mainstream of closings. Here’s why they should be.

MBA Weekly Survey June 29, 2022: Applications Increase Again

Mortgage applications rose for the third week in a row, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending June 24.

MBA, Winnow Solutions LLC Partner to Help Members with Compliance Research, Costs

The Mortgage Bankers Association and Winnow Solutions LLC, Anaheim, Calif., announced a partnership that will provide MBA member subscribers – at a 10% discount rate – a comprehensive database of state and federal regulations to help control costs and better manage the growing complexity of mortgage regulations.

MISMO Issues Dataset Standard for IRS Form 4506-C

MISMO®, the real estate finance industry’s standards organization, launched a new dataset standard for the Internal Revenue Service Request for Transcript of Tax Return (IRS Form 4506-C).

Anita Bush of FICS: Mortgage Servicers Must Improve Support for Borrowers with Limited English Skills

Mortgage servicers must provide language resources for borrowers with limited English proficiency. The 2020 Census confirmed what mortgage professionals have experienced over the past decade – America’s diversity increases every year with minority homeownership growing rapidly.

Quote

“Aging and mortality are glacial and largely predictable. Based purely on changing demographics and population growth, there is enough homebuyer demand to meet most of the existing inventory that will come onto the market over the next decade and beyond from older homeowners.”

–Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University, in a new MBA RIHA study, Who Will Buy the Baby Boomers’ Homes When They Leave Them.

Housing Market Roundup June 29, 2022

Here is a summary of recent housing, market and economic reports that have come across the MBA NewsLink desk:

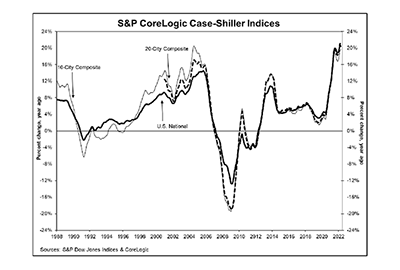

Home Price Indices Approach, Exceed 20% Annual Rate

Two home price indices on Tuesday showed home price appreciation approaching and in one case exceeding a 20 percent annual rate.

Redfin: Demand for Vacation Homes Falls Below Pre-Pandemic Levels

Redfin, Seattle, said demand for vacation homes has fallen below the pre-pandemic baseline for the first time in two years, with mortgage-rate locks for second homes down 4 percent from before the pandemic in May.