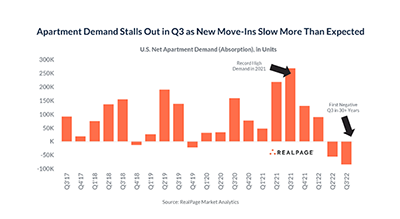

RealPage, Richardson, Texas, said apartment demand plunged in the third quarter as new leasing stalled far more than expected.

Category: News and Trends

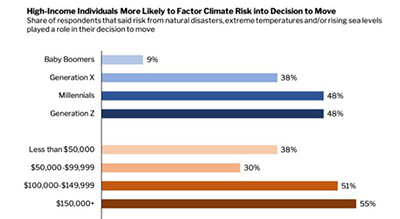

Homebuyers, Sellers Start Shifting on Climate Risk Issues

Earlier this year, you could get a bidding war for swampland in Florida. Now, said Redfin, Seattle, homebuyers and sellers are getting pickier—and particularly when it comes to climate risk.

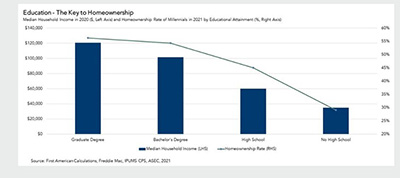

Educated Millennials Hold Key to Future Homeownership Demand

First American Financial Corp., Santa Ana, Calif., said in challenging housing market conditions with higher interest rates, certain fundamentals will drive future growth. One such driver, said First American Deputy Chief Economist Odeta Kushi, is level of education.

Dealmaker: Northmarq Arranges $21M for North Carolina Retail Center

Northmarq’s St. Louis, Mo., office arranged $21 million in acquisition financing for Bradford Square retail center in Cary, N.C.

Rita Moreno Keynotes mPower Event at MBA Annual22

Rita Moreno–Academy Award-winning actress, dancer and singer and recipient of the Presidential Medal of Freedom–keynotes the mPower Event at the Mortgage Bankers Association in Nashville, Tenn.

Mortgage Credit Availability Falls to 9-Year Low

Mortgage credit availability fell in September for the seventh straight month to its lowest level since 2013, the Mortgage Bankers Association reported Tuesday.

Quote

“The new that job growth and wage growth continued in September is positive for the housing market, as higher incomes support housing demand. However, it also pushed off the possibility of any near-term pivot from the Federal Reserve on its plans for additional rate hikes.”

–MBA Chief Economist Mike Fratantoni.

Jeremy Yohe of ALTA: Alternatives to Title Insurance Increase Lender Risk

Attorney opinions, in providing more limited coverage of title risks, represent a shifting of risk to the lender because they are responsible for representations and warranties for the life of the loan that pertain to clear title and first-lien enforceability.

Voting for 2023 MBA Officers, New & Returning Directors Underway; Deadline Oct. 14

The voting period for election of the Mortgage Bankers Association’s FY 2023 officers and new and returning directors is underway. Voting ends at 5:00 p.m. ET on Friday, Oct. 14.

MBA Premier Member Profile: Constellation Mortgage Solutions

Constellation Mortgage Solutions provides industry-leading lending technology solutions through its products: Mortgage Builder LOS, Mortgage Builder LSS, ReverseVision LOS and our new LOS – NOVA.