The Treasury Department issued new guidance Wednesday to increase state, local and tribal governments’ ability to use American Rescue Plan funds to increase affordable housing. The Mortgage Bankers Association commended the Biden administration for its commitment to addressing the ongoing housing shortage.

Category: News and Trends

Consumer Confidence Declines Moderately

Consumer confidence decreased in July, following a larger decline in June, The Conference Board reported.

Dealmaker: JLL Arranges $30M Senior Living Community Refinancing

JLL Capital Markets, Chicago, arranged a $29.5 million refinancing for Mirror Lake Village, a 114-unit Class A independent living, assisted living and memory care community in Federal Way, Wash.

Freddie Mac: Approaches to Low-Income Housing Climate Resiliency Vary

As the number of weather-related disasters increases, states have implemented a range of requirements and incentives to mitigate their impact on federal Low-Income Housing Tax Credit properties, reported Freddie Mac, McLean, Va.

Quote

“MBA is grateful the House has passed this legislation that creates federal minimum standards to allow notaries in all states to perform safe and effective remote online notarization transactions, making the mortgage closing process more convenient for all consumers–including our nation’s military families.”

–Robert Broeksmit, CMB, President and CEO of the Mortgage Bankers Association.

S&P: Self-Service Residential Mortgage Servicing Increasing

The number of calls per loan to mortgage servicers has decreased as self-service options become more widespread and borrowers can resolve basic requests on their own, reported S&P Global Market Intelligence.

MBA Weekly Survey July 27, 2022: Mortgage Applications Decrease Again

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 22, 2022.

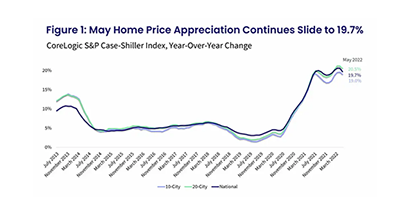

Home Price Appreciation Slows

House prices rose nationwide in May, but at a slower pace than in April, two home price indices reported on Tuesday.

Call for Entries: MBA DEI Leadership Awards–Deadline Aug. 5

The Mortgage Bankers Association is accepting entries for its annual Diversity, Equity and Inclusion Residential Leadership Awards; entry deadline is Friday, Aug. 5. Annually, MBA recognizes residential and commercial/multifamily members …

‘Agility is the Name of the Game’: Polly CEO Adam Carmel

Adam Carmel is Founder and CEO of Polly. He experienced firsthand the fundamental gaps that existed in legacy software solutions. After recognizing that a modern, cloud-native alternative did not exist, Adam founded Polly and developed the industry’s first vertically integrated, data-driven capital markets software solution that allows for unlimited flexibility, configurability and scalability.