As the number of weather-related disasters increases, states have implemented a range of requirements and incentives to mitigate their impact on federal Low-Income Housing Tax Credit properties, reported Freddie Mac, McLean, Va.

Category: News and Trends

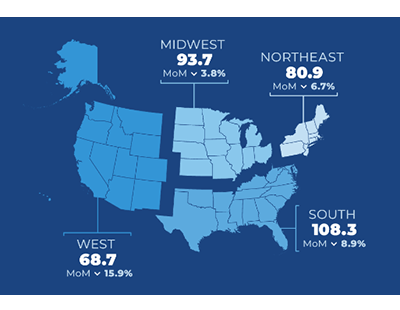

MBA Weekly Survey July 27, 2022: Mortgage Applications Decrease Again

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 22, 2022.

Call for Entries: MBA DEI Leadership Awards–Deadline Aug. 5

The Mortgage Bankers Association is accepting entries for its annual Diversity, Equity and Inclusion Residential Leadership Awards; entry deadline is Friday, Aug. 5

‘Agility is the Name of the Game’: Polly CEO Adam Carmel

Adam Carmel is Founder and CEO of Polly. He experienced firsthand the fundamental gaps that existed in legacy software solutions. After recognizing that a modern, cloud-native alternative did not exist, Adam founded Polly and developed the industry’s first vertically integrated, data-driven capital markets software solution that allows for unlimited flexibility, configurability and scalability.

MBA Premier Member Profile: Salesforce

Salesforce is the #1 CRM, bringing companies and customers together in the digital age.

MBA Home For All Pledge Partner: United Community Bank

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

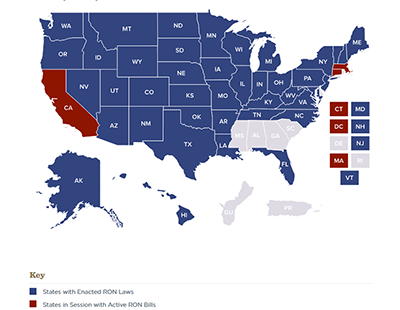

MBA Applauds House Passage of Remote Online Notarization Bill

The House on Wednesday passed legislation that creates federal minimum standards to allow notaries in all states to perform remote online notarization transactions. The Mortgage Bankers Association applauded the news.

FOMC Raises Federal Funds Rate 75 Basis Points

The Federal Open Market Committee hiked the federal funds rate by 75 basis points on Wednesday, matching its 75 basis point increase in June.

Mortgage Industry Compliance Concerns and Best Practices

Rhonda McGill, Senior Director of Client Solutions with PerformLine, Morristown, N.J. Her team provides regulatory and marketing compliance expertise to lead PerformLine’s voice of the customer initiatives as the company continues to invest in the development of its industry-leading compliance technology. She also hosts industry roundtables and moderates webinars to highlight the latest developments and trends in the industry.

Pending Home Sales Fall 8.6%

Pending home sales decreased in June following a slight increase in May, the National Association of Realtors said Wednesday.