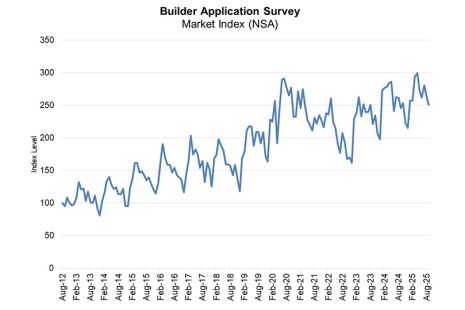

MBA’s Builder Application Survey for September 2025 shows mortgage applications for new home purchases increased 2% compared from a year ago. Compared to August 2025, applications decreased by 5%.

Category: News and Trends

Why Retaining Servicing Remains Critical in 2025’s Evolving Mortgage Market (Sponsored by FICS)

FICS President and Chief Operating Officer Susan Graham says retaining servicing remains critical in 2025’s evolving mortgage market.

Plan Ahead: Download the MBA Events App

The MBA Events mobile app puts MBA Annual25 at your fingertips.

MBA Annual Speaker Lineup

Check out the lineup of expert speakers scheduled to be in Las Vegas for MBA Annual25

Voting for 2026 MBA Officers, New & Returning Directors Underway

The voting period for election of the Mortgage Bankers Association’s FY 2026 officers and new and returning directors is underway.

Modern Technology Powers Better Lending (Sponsored by Optimal Blue)

Homebuying should feel empowering. With AI and modern, proven tools, lenders are creating faster, clearer, and more personalized borrower journeys.

Visit Our Exhibitors

MBA Annual25 gives you access to leading companies that provide products and services you can use to take your business to the next level:

Multiple Lines of Defense: Combating Fraud in the Digital Closing Era

NotaryCam’s Suzanne Singer writes that as fraudsters innovate, the mortgage industry must respond in kind.

It’s All Happening in THE HUB

This year THE HUB will be better than ever. We’re making THE HUB the heart of the convention, with guaranteed traffic from thousands of attendees and premier companies, and a prime location with breakout session rooms positioned inside the expo hall.

Things to Do, See in Las Vegas

MBA Annual has not been in Las Vegas since 2014. So we put together some ideas for what you might want to see and do during your visit to the entertainment capital of the world.