LAS VEGAS–The Mortgage Bankers Association announced at its 2025 Annual Convention and Expo that Chioma Kalu has been recognized as the David H. Stevens Real Estate Legacy Scholarship award winner. The award recognizes students from MBA’s Commercial Real Estate Finance Fellowship Program and HomeFree-USA’s Center for Financial Advancement Program who have shown career aspirations in the real estate finance industry.

Category: News and Trends

MBA Annual25: Monday’s General Sessions

Here’s a handy guide to Monday’s general sessions at MBA Annual25 in Las Vegas.

Zillow Finds Rental Affordability Reaches Four-Year High

Rental affordability is better than any time in the past four years, giving prospective renters a slight break on new leases, according to Zillow, Seattle.

MBA Annual25: Tuesday’s General Sessions

Here’s a handy guide to Tuesday’s general sessions at MBA Annual25 in Las Vegas.

Industry Briefs, Oct. 20, 2025

Industry news from Floify, Dark Matter Technologies, Xactus, Docutech, Friday Harbor, LoanCare, DocMagic, ALCOVA Mortgage and Down Payment Resource.

Advocacy Update: Stalemate Continues as Federal Government Shutdown Enters Third Week; Read MBA’s Member Guide

This week’s top legislative and policy news from the Mortgage Bankers Association.

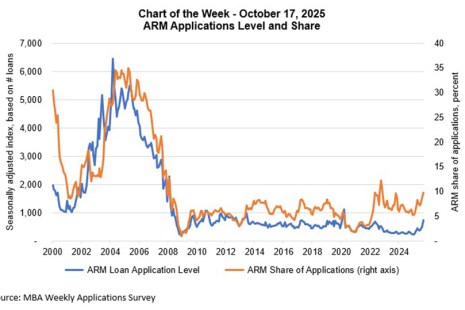

Chart of the Week: ARM Applications Level and Share

Adjustable-rate mortgages (ARMs), when used appropriately, can help ease affordability challenges and provide homeownership and equity building opportunities for qualified borrowers.

2025 Mortgage Compliance Landscape Check-In: Where are We Now?

Jonas Hoerler and Diane Jenkins from Asurity provide an overview of some of the most significant events that have shaped mortgage lending and servicing so far this year.

MBA Annual Show Guide is Now Online

MBA has published an electronic version of Mortgage Banking: the MBA Annual Show Guide.

Voting for 2026 MBA Officers, New & Returning Directors Underway

The voting period for election of the Mortgage Bankers Association’s FY 2026 officers and new and returning directors is underway.