Total nonfarm payroll employment rose by 128,000 in October, while the unemployment rate rose slightly to 3.6 percent, the Bureau of Labor Statistics reported Friday.

Category: News and Trends

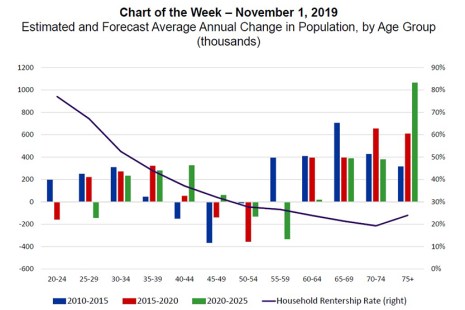

MBA Chart of the Week: Changes in Population By Age Group

Housing demand in the U.S. is expected to grow considerably over the next decade, as the large Baby Boomer cohort grows into age groups formerly held by the Silent Generation, and Millennials mature into age ranges formerly populated by the smaller Generation X. In each of the past two years, these trends have helped add a net 1.6 million households.

Commercial Servicing Software Must be Flexible

Commercial servicing software needs to be flexible and scalable. It must accommodate a variety of loan products; include commercial-specific reporting, payment and escrow administration functionality; and provide support for asset managers.

First American: Mortgage Fraud Risk at Three-Year Low

First American Financial Corp., Santa Ana, Calif., said frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications fell for the sixth consecutive month in September to its lowest level since December 2016.

SEC to Examine Disclosure Requirements for RMBS

Securities and Exchange Commission Jay Clayton this week issued a statement instructing SEC staff to review the Commission’s residential mortgage-backed securities asset-level disclosure requirements with an eye toward facilitating more SEC-registered offerings.

TransUnion: Housing Market to Get Boost as First-Time Homebuyers Rise

The recovering housing market may soon receive a bigger boost, said TransUnion, Chicago. Its analysis projects at least 8.3 million first-time homebuyers to enter the mortgage market between 2020 and 2022.

CFPB, Fed, OCC Increase Thresholds for Small Loan Exemption Appraisal Requirements for Higher-Priced Mortgage Loans

The Consumer Financial Protection Bureau, Federal Reserve Board and Office of the Comptroller of the Currency yesterday announced the threshold for exempting loans from special appraisal requirements for higher-priced mortgage loans during 2020 will increase from $26,700 to $27,200.

Commercial Servicing Software Must be Flexible

Commercial servicing software needs to be flexible and scalable. It must accommodate a variety of loan products; include commercial-specific reporting, payment and escrow administration functionality; and provide support for asset managers.

Fed Drops Funds Rate for 3rd Time This Year

The Federal Open Market Committee, as expected, cut the federal funds rate by 25 basis points following conclusion of yesterday’s policy meeting.

3Q GDP Advance Estimate Slows to 1.9%

Real gross domestic product increased at an annual rate of 1.9 percent in the third quarter, marking a continued trend of slowing economic growth, the Bureau of Economic Analysis reported in its first (advance) estimate yesterday.