Leadership during times of economic opaqueness, scary events and political drama can lack efficacy. What worked in the past is a poor roadmap into the future–whack-a-mole urgency will widen the gaps between enterprises. Innovation and automation may be the only certainties over the next 18 months.

Category: News and Trends

MBA Letter Supports Self-Employed Mortgage Access Legislation

Ahead of an anticipated vote this week in the House Financial Services Committee, the Mortgage Bankers Association yesterday sent a letter of support for legislation that would help ensure fair access to mortgage credit for households with “non-traditional” forms of income.

CoreLogic: Lowest August Delinquency Rates in 20 Years

CoreLogic, Irvine, Calif., said just 3.7% of mortgages were in some stage of delinquency in August, down by 0.2 percent from a year ago to its lowest rate since 1999.

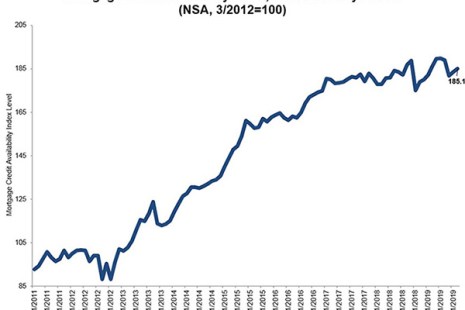

October MBA Mortgage Credit Availability Index Up 1%

Mortgage credit availability increased in October, the Mortgage Bankers Association reported this morning.

MBA Advocacy Update

Last Friday, MBA President and CEO Bob Broeksmit, CMB, attended a White House meeting chaired by HUD Secretary Ben Carson and attended by other senior administration officials and key industry stakeholders to discuss housing affordability. And on Monday, the Federal Housing Finance Agency announced it is seeking comment on pooling practices for Fannie Mae and Freddie Mac in the Uniform Mortgage-Backed Securities market.

CSBS License Renewal Period Underway; Deadline Dec. 31

The Conference of State Bank Supervisors announced the start of the license renewal period for individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to consumers. These individuals and businesses are required to maintain and renew licensure through the Nationwide Multistate Licensing System.

Balancing the Joy of Home-Buying and the Agony of Mortgage Loan Processing with Blockchain

Close your eyes and imagine a world with real-time borrower and property data available that was guaranteed to be accurate. Pipe dream you say? I say near-future achievable.

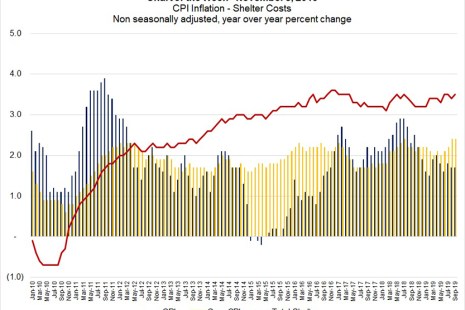

MBA Chart of the Week: CPI Inflation–Shelter Costs

Housing affordability challenges–for both buying and renting–continue to be a topic of discussion. According to the Bureau of Labor Statistics, shelter costs continue to outpace the price growth of overall goods and services, as measured by the Consumer Price Index.

The Week Ahead

A busy month continues for the Mortgage Bankers Association, with several reports coming in the next two weeks.

Ellie Mae: Millennial Home Refinance Boom at 3-Year High

Ellie Mae, Pleasanton, Calif., said Millennials closed 33% of all mortgage refinances in September, the largest such share since it began tracking data in January 2016.