Mortgage applications increased from one week earlier as key interest rates stayed below 4 percent, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 22.

Category: News and Trends

FHFA Increases 2020 Maximum Conforming Loan Limits to $510,400

The Federal Housing Finance Agency today announced maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2020, with the 2020 maximum conforming loan limit for one-unit properties rising to $510,400 from $484,350.

People in the News

New American Funding, Tustin, Calif., appointed Marlene Veal as Vice President of its Western Builder Division, responsible for creation and development of teams to support home builders and their buyers.

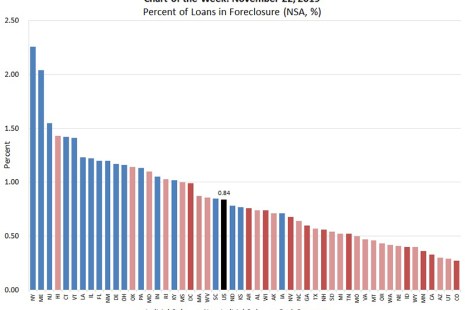

MBA Chart of the Week: Percent of Loans in Foreclosure

The third quarter results of MBA’s National Delinquency Survey, released last week showed improvements in delinquency and foreclosure measures.

MISMO Releases Closing Instructions Templates for Public Comment

MISMO®, the mortgage industry standards organization, released its new closing instructions templates for public comment.

Hello, Diversity: I’m Equality

(By Aneeza Haleem) Tolerance, diversity and inclusion should not be political opinions or corporate checkboxes–they are non-negotiable human rights.

FHFA Increases 2020 Maximum Conforming Loan Limits to $510,400

The Federal Housing Finance Agency today announced maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2020, with the 2020 maximum conforming loan limit for one-unit properties rising to $510,400 from $484,350.

MBA Mortgage Action Alliance Issues ‘Call to Action’ on G-Fees Bill

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a “Call to Action” yesterday urging its members to contact their House representative in support of a bill that would prohibit Congress from using Fannie Mae and Freddie Mac guarantee fees as a source of funding for non-housing related spending.

Black Knight’s First Look: Strong Decline in October Mortgage Delinquencies; Refis Pushes Prepayments to Highest Level in 6 Years

Black Knight, Jacksonville, Fla., said its First Look Mortgage Monitor reported the national mortgage delinquency rate fell to 3.39% in October, a nearly 7% decline from the past year and within 0.03% of the record low set in May.

Survey: Generation Z ‘Ambitious Yet Realistic’ About Homeownership

Stop wondering about Millennial homeownership–it’s already time to think about the generation beyond that.