Mortgage applications fell for the week ending Dec. 20 from one week earlier as key interest rates edged up, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

Category: News and Trends

Allen Price: Don’t Let Natural Disasters Become Servicing Disasters

Natural disasters have become seemingly commonplace, as every season seems to bring a major storm, flood, hurricane or wildfire somewhere in the country. These events obviously have devastating impacts on homeowners. But on one level or another, they have also revealed weaknesses among mortgage servicers and their ability to respond appropriately.

ARMCO: Critical Defect Rate Improves; FHA Loan Quality Decreases

ACES Risk Management, Denver, released its quarterly Mortgage QC Trends Report, showing a continued drop in overall critical defects but an uptick in FHA loan performance.

Mortgage Vendor News & Views—End-of-Year Edition–Scott Roller

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. Today we focus on a subset of vendors whereby each have an intriguing model adding value to clients – and substantially serving borrowers too. Technology is blurring the lines, enabling innovation and expansion of traditional business boundaries.

MBA Offers Recommendations to Ginnie Mae Digital Collateral Guide

The Mortgage Bankers Association, in a Dec. 23 letter to Ginnie Mae, offered a series of recommendations as the agency develops its upcoming Digital Collateral Guide.

MBA Year-End Advocacy Update

In 2019, with the confirmation of Mark Calabria to head the Federal Housing Finance Agency and the release of the Trump administration’s reform plans, housing finance reform took center stage again. Against that backdrop, MBA continued to assert its position as the thought leader on all elements of housing finance reform.

New Home Sales Post Modest November Increase

November sales of new single‐family houses rose by 1.3 percent from October and by nearly 17 percent from a year ago, HUD and the Census Bureau reported yesterday.

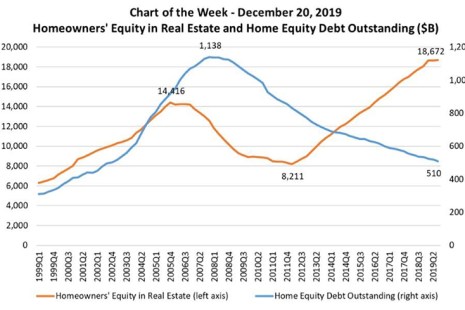

MBA Chart of the Week: Homeowner Equity in Real Estate

In the third quarter, homeowners’ equity in real estate reached $18.7 trillion–continuing a run of consecutive quarterly increases dating back to 2012.

MBA Advocacy Update

On Thursday, the Senate passed the fiscal year 2020 domestic “minibus” appropriations bill (H.R. 1865), which now awaits the president’s signature. Significant provisions supported by MBA – such as another $20 million tranche for Federal Housing Administration single-family technology upgrades, specific real-estate-related tax extenders, and a status quo extension of the National Flood Insurance Program through September 30, 2020 – were included in the package.

MBA, Trade Groups Urge HUD Implementation of New Loan-Level Certification Rules

The Mortgage Bankers Association and other industry trade groups last week commended HUD for making recommended changes to FHA-insured mortgages and urged the department to move forward to implementation.