MBA NewsLink provides a clarification to a story that ran last week.

Category: News and Trends

The Week Ahead

The past four years have been anything but “normal” in Washington, D.C.–if there’s even such a thing as “normal.” But with an impending impeachment trial hanging over the Senate, things could get even weirder.

December Report Caps Solid Year of Jobs, Wage Growth

Total nonfarm payroll employment rose by 145,000 in December, slightly lower than previous months, the Bureau of Labor Statistics reported Friday.

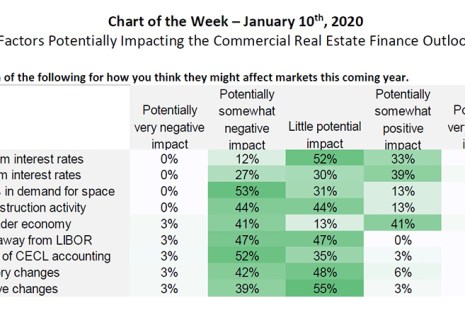

MBA Chart of the Week: Factors Impacting Commercial Real Estate Finance

Buoyed by low interest rates, strong property markets and rising property values, commercial and multifamily mortgage banking firms anticipate a solid year in 2020, according to MBA’s 2020 Commercial Real Estate Finance (CREF) Outlook Survey.

MBA Advocacy Update

On December 23, MBA sent a letter to Ginnie Mae offering recommendations on how the agency can improve its upcoming Digital Collateral Guide. Last week, the U.S. Department of Homeland Security and the New York Department of Financial Services both issued warnings alerting companies to potential cybersecurity risks. And on December 20, the Georgia Department of Banking and Finance finalized rules regarding mortgage loan originator temporary authority.

Mark P. Dangelo: 2020—Where Are OUR Attack Points?

In this third and final article on 2020 potential challenges, we find ourselves staring into the glassy lake. The answers on what is important reside not with prescriptive solutions offered, but beneath the surface to ensure that what is undertaken aligns with strategy and the ability of innovations to be found.

Jay Coomes: Advance Your Efficiency

Smoother internal processes can lead to happier consumers, increased profitability and reduced costs. Somewhere in your internal processes, you also have efficiencies to gain.

FHFA: Nearly 4.4 Million Homeowners Helped Since Conservatorship

The Federal Housing Finance Agency released its quarterly Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 26,475 foreclosure prevention actions in the third quarter, bringing the total number of foreclosure prevention actions to 4.38 million since September 2008.

Veros: U.S. Real Estate Appreciation to Continue Throughout 2020

Veros Real Estate Solutions, Santa Ana, Calif., said its fourth quarter VeroFORECAST data project home prices in the nation’s 100 largest markets to increase by nearly 4 percent through December.

‘Silicon Prairie’ Communities Top List of Up-and-Coming Tech Markets

Looking for a place to launch—or provide a mortgage to—a startup? Oklahoma City, Kansas City and Jacksonville provide best potential for growth, while affordability and labor-competition challenges see Silicon Valley desirability fade, according to a new report from Zillow Inc., Seattle.