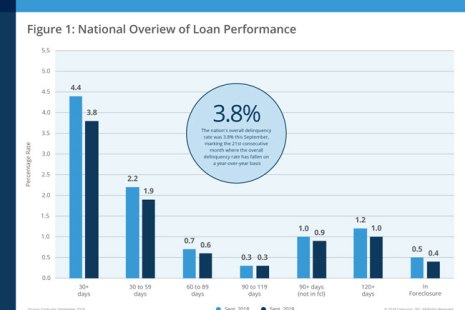

CoreLogic, Irvine, Calif., reported 3.7% of mortgages were in some stage of delinquency in October, an 0.4 percentage point decline from a year ago.

Category: News and Trends

Stanley C. Middleman: Are Non-banks Really a Systemic Risk?

The Financial Stability Oversight Council issued its annual report in December where it identified the growth of nonbank mortgage origination and servicing as a risk to the U.S. financial system. But is this really correct?

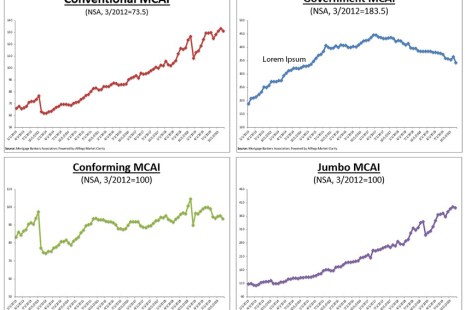

MBA: December Mortgage Credit Availability Decreases by 3.5%

Mortgage credit availability fell in December for the first time in four months, the Mortgage Bankers Association reported this morning.

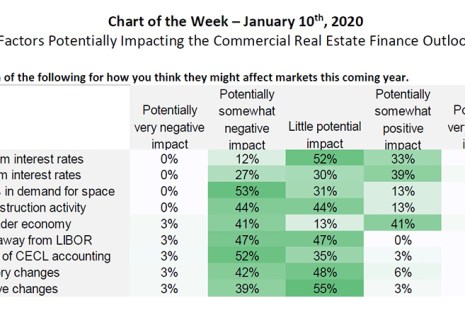

MBA Chart of the Week: Factors Impacting Commercial Real Estate Finance

Buoyed by low interest rates, strong property markets and rising property values, commercial and multifamily mortgage banking firms anticipate a solid year in 2020, according to MBA’s 2020 Commercial Real Estate Finance (CREF) Outlook Survey.

MBA Advocacy Update

On December 23, MBA sent a letter to Ginnie Mae offering recommendations on how the agency can improve its upcoming Digital Collateral Guide. Last week, the U.S. Department of Homeland Security and the New York Department of Financial Services both issued warnings alerting companies to potential cybersecurity risks. And on December 20, the Georgia Department of Banking and Finance finalized rules regarding mortgage loan originator temporary authority.

Mark P. Dangelo: 2020—Where Are OUR Attack Points?

In this third and final article on 2020 potential challenges, we find ourselves staring into the glassy lake. The answers on what is important reside not with prescriptive solutions offered, but beneath the surface to ensure that what is undertaken aligns with strategy and the ability of innovations to be found.

Jay Coomes: Advance Your Efficiency

Smoother internal processes can lead to happier consumers, increased profitability and reduced costs. Somewhere in your internal processes, you also have efficiencies to gain.

Call for Nominations: MBA NewsLink 2020 Tech All-Star Awards; Deadline Extended to Jan. 17

The Mortgage Bankers Association and MBA NewsLink are accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. The nomination deadline has been extended to Friday, Jan. 17.

MBA: December Mortgage Credit Availability Decreases by 3.5%

Mortgage credit availability fell in December for the first time in four months, the Mortgage Bankers Association reported this morning.

Clarification

MBA NewsLink provides a clarification to a story that ran last week.