Technology is no longer an option; it is an integral element. Inefficient, outdated, manual processes can be risky and ultimately end up costing the lender. To combat these challenges, today’s lenders must stay abreast of cutting-edge technology. Implementing such technology, lenders can exponentially increase their bottom line as well as bring unexpected savings and benefits.

Category: News and Trends

(Sponsored Content) Don’t Overlook This Surprising CRE Capital Source

In a fast-changing business environment, lenders don’t always act as expected, so it’s necessary to have a longer list of capital provider choices on-hand.

People in the News

Success Mortgage Partners Inc., Plymouth, Mich., named Allison Johnston, CMB, as President.

Mark P. Dangelo: The Challenges of Reskilling Workforces, Part 1

With limited population growth domestically, the search for advanced technology skills must embrace aging populations and the explosion of megacities beyond our shorelines—new, continuous models of corporate education, training and partnering must be adopted.

MBA Advocacy Update

This past Tuesday, MBA joined other trade associations to provide a detailed account of the costs and burdens of implementing the TRID Rule in response to the CFPB’s RFI on its TRID Rule assessment. Also on Tuesday, MBA submitted a comment letter to the FHFA cautioning against suggested changes to its UMBS pooling practices.

The Week Ahead

The impeachment trial of President Trump continues in the Senate for a second week, a spectacle that has captured the attention of Washington, as well as people across the country and around the world.

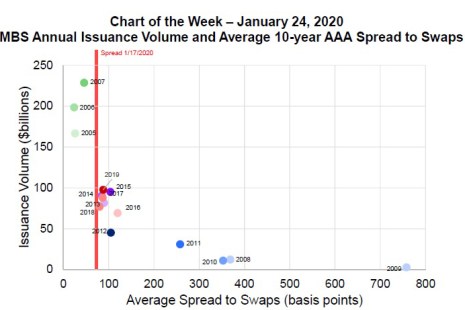

MBA Chart of the Week: CMBS Annual Issuance Volume

After a slow start in 2019, the commercial mortgage-backed securities market ended strong, with $39.1 billion of private-label CMBS issuance during the fourth quarter – more than double the $18.8 billion issued during fourth quarter 2018.

Patrick McClain: Hard and Soft Savings–How Technology Can Positively Impact Bottom Line

Technology is no longer an option; it is an integral element. Inefficient, outdated, manual processes can be risky and ultimately end up costing the lender. To combat these challenges, today’s lenders must stay abreast of cutting-edge technology. Implementing such technology, lenders can exponentially increase their bottom line as well as bring unexpected savings and benefits.

(Sponsored Content) Don’t Overlook This Surprising CRE Capital Source

In a fast-changing business environment, lenders don’t always act as expected, so it’s necessary to have a longer list of capital provider choices on-hand.

Mark P. Dangelo: The Challenges of Reskilling Workforces, Part 1

With limited population growth domestically, the search for advanced technology skills must embrace aging populations and the explosion of megacities beyond our shorelines—new, continuous models of corporate education, training and partnering must be adopted.