Today’s loan officers and branch managers face many challenges–from cumbersome, time-consuming processes to difficulties connecting with borrowers, and lenders have made significant investments in technology to help. However, many are learning that a siloed technology approach or implementation of the wrong technology can cause more headaches than it solves.

Category: News and Trends

MBA Coronavirus Resource Center Update: CSBS Repository; MBA Member Letter

In a Mar. 13 Member Letter, MBA President and CEO Robert Broeksmit, CMB, detailed MBA’s efforts with various federal regulatory agencies, including HUD and Ginnie Mae, as well as the Federal Housing Finance Agency, Fannie Mae and Freddie Mac, to streamline policies and procedures that will allow lenders to assist borrowers throughout the coronavirus pandemic.

How the Mortgage Market Has Changed Since Great Recession

A report from Clever Real Estate said in the years since the Great Recession, the mortgage market—currently exploding in refinances—remains a “mixed bag.”

MBA Coronavirus Resource Center Update

The MBA Coronavirus Resource Center includes information from health/disease control agencies, recommended business continuity plans, relevant information from financial regulatory agencies, as well as guidance on how companies should communicate with employees, their customers and the public.

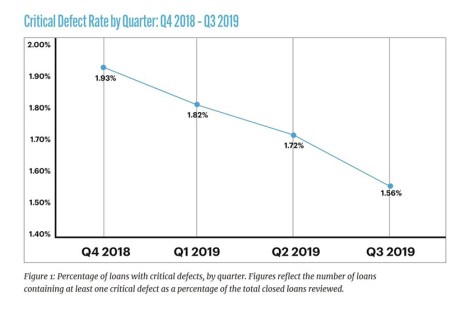

ARMCO: Critical Defect Rate Drops 9%

ACES Risk Management, Denver, said the overall critical defect rate reached 1.56% in the third quarter, to the lowest defect rate since 2016.

Home Buyers Have More Purchasing Power, But Face Inventory, Coronavirus Headwinds

A dramatic drop in mortgage interest rates, driven by coronavirus fears, has given homebuyers a big boost in purchasing power in recent weeks, according to an analysis from Redfin, Seattle.

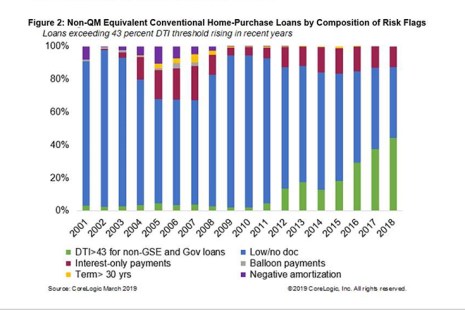

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure.

Todd Sheinin: For Loan Officers, Integrating Right Technology Key to Borrower Experience

Today’s loan officers and branch managers face many challenges–from cumbersome, time-consuming processes to difficulties connecting with borrowers, and lenders have made significant investments in technology to help. However, many are learning that a siloed technology approach or implementation of the wrong technology can cause more headaches than it solves.

House Committee Asks Regulators, Financial Institutions to Report on Coronavirus Actions

House Financial Services Committee Chair Maxine Waters, D-Calif., sent a letter to Administration officials, regulators and financial services organizations (including MBA President and CEO Robert Broeksmit, CMB, and credit reporting agencies expressing concerns about risks related to the coronavirus pandemic and steps they are taking to prevent Americans and the financial system from being harmed.

MISMO Proposes Updates to Industry Loan Application Dataset

MISMO, the mortgage industry standards organization, today released proposed updates to the Industry Loan Application Dataset, its modernized dataset for the exchange of loan application data.