On the website of Clarifire, a Software-as-a-Service company specializing in workflow automation in multiple industries, particularly mortgage servicing, the company declares its vision: “To transform chaos into clarity.” And that is a philosophy perfectly embodied by MBA 2020 Tech All-Star Jane Mason, CEO and founder of St. Petersburg, Fla.-based Clarifire.

Category: News and Trends

MBA 2020 Tech All-Star Howard Botts: Meet the Wizard of ‘Weather Forensics’

Howard Botts could be in Los Angeles and tell you within 15 minutes of a tornado touching down in the Midwest, if any, properties sustained damage and the severity of the damage. He’s not psychic; he’s scientific.

MBA Tech All-Star Rick Triola: The Crusade for Remote Online Notarization

One of the most remarkable mortgage technology developments in the past couple of years has been emergence of Remote Online Notarization as standard operating procedure. And the industry has Rick Triola to thank for that.

People in the News

LenderClose, Des Moines, Iowa, appointed Tana Krumm as Vice President of Marketing, responsible for analyzing the market to formulate and position differentiating marketing strategies.

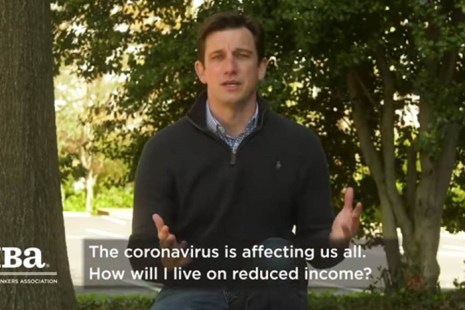

MBA Creates Print, Video PSAs for Members to Communicate COVID-19 Resources

To help inform consumers about the appropriate time to contact their mortgage companies, the Mortgage Bankers Association has created a 30-second video and corresponding ads for members’ use.

People in the News

LenderClose, Des Moines, Iowa, appointed Tana Krumm as Vice President of Marketing, responsible for analyzing the market to formulate and position differentiating marketing strategies.

Another Week for Record Unemployment Claims

The Labor Department yesterday reported a record 6.648 million Americans filed initial unemployment insurance claims last week, smashing the previous record set the previous week.

First American: Fraud Risk Continues to Drop

Today’s housing market benefits from new technology and policy guardrails against fraud and defect risk, innovations that will serve the industry well in the uncertain days ahead, said Mark Fleming, Chief Economist with First American Financial Corp. Santa Ana, Calif.

Ellie Mae: Older Millennials Drive February Refinance Surge

Older Millennials—and yes, there is such a thing—took advantage of near record-low interest to spark a surge in refinancings, according to the Millennial Tracker report from Ellie Mae, Pleasanton, Calif.

ATTOM: February Foreclosure Activity at Record Low

ATTOM Data Solutions, Irvine, Calif., reported 48,004 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in February, the lowest number of total foreclosure filings recorded it began tracking in April 2005.