To help inform consumers about the appropriate time to contact their mortgage companies, the Mortgage Bankers Association has created a 30-second video and corresponding ads for members’ use.

Category: News and Trends

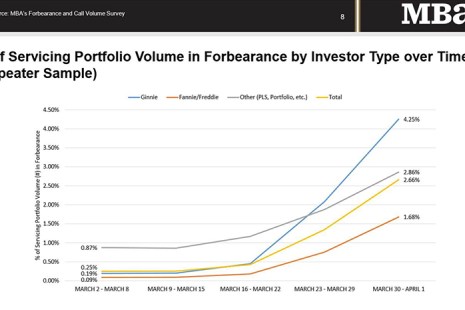

MBA Survey Shows Spikes in Loan Forbearance, Servicer Call Volumes

New survey findings from the Mortgage Bankers Association highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

MBA Mortgage Action Alliance ‘Call to Action’ Urges Governors to Prioritize Mortgage Relief Efforts

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” yesterday, asking its members to contact their state governors and urge them to prioritize mortgage and rental assistance for those in greatest need.

Dealmaker: JLL Arranges $137M for Multifamily

JLL Capital Markets arranged nearly $137 million in financing for multifamily projects in California, Colorado and New Jersey.

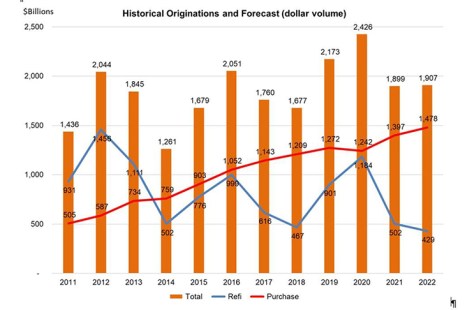

MBA April Economic Commentary: Economy Slows Sharply; Massive Job Loss; but V-Shaped Recovery in Forecast

The spread of the coronavirus has slowed global and U.S. economic activity to a halt. Public and private measures to stem the spread of the virus have led to indefinite interruptions in many sectors of the economy, as well as future uncertainty surrounding how long this pause in the global economy will last and what the potential economic losses could be.

MISMO Update: Spring Summit Goes Virtual; New MISMO Job Openings

MISMO announced its Spring Summit, scheduled for June 1-5 in Charleston, S.C., will now take place virtually.

Andrew Foster, Kelly Hamill: First Aid–Paycheck Protection Program Begins

The $2 trillion CARES Act bill is designed in part to provide liquidity to small businesses—including hard hit hotels—who will turn to the program first to cover costs such as payroll, utilities and interest on debt payments. Commercial real estate borrowers, tenants and their employees are prime candidates to apply for the program and many of MBA’s member banks will be instrumental in getting this $350 billion of relief to small businesses and their employees in communities across the country through their SBA lending programs.

MBA Creates Print, Video PSAs for Members to Communicate COVID-19 Resources

To help inform consumers about the appropriate time to contact their mortgage companies, the Mortgage Bankers Association has created a 30-second video and corresponding ads for members’ use.

MBA 2020 Tech All-Star Jane Mason: Bringing Clarity to Chaos

On the website of Clarifire, a Software-as-a-Service company specializing in workflow automation in multiple industries, particularly mortgage servicing, the company declares its vision: “To transform chaos into clarity.” And that is a philosophy perfectly embodied by MBA 2020 Tech All-Star Jane Mason, CEO and founder of St. Petersburg, Fla.-based Clarifire.

MBA 2020 Tech All-Star Rick Triola: The Crusade for Remote Online Notarization

One of the most remarkable mortgage technology developments in the past couple of years has been emergence of Remote Online Notarization as standard operating procedure. And the industry has Rick Triola to thank for that.