Fannie Mae, Washington, D.C., said its monthly Home Purchase Sentiment Index fell by 11.7 points to 80.8 in March, its lowest reading since December 2016.

Category: News and Trends

CMBS Report: More Than 2,600 U.S. CMBS Borrowers Seek Coronavirus Relief; Delinquency Reports Mixed

Fitch Ratings, New York, reported more than 2,600 commercial real estate borrowers, representing $49.1 billion of mortgage loans, have sought potential debt relief during the first two weeks of the U.S. coronavirus outbreak.

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

Nearly all companies have engaged in some form of business continuity planning. Generally, this exercise centers around developing contingency plans for maintaining normal operations in the face of a natural disaster or IT outage. However, with concerns surrounding coronavirus sending shockwaves throughout the U.S. and global economies, mortgage companies would be well advised to add pandemics to their list of events that could disrupt normal operations, as this specific type of incident poses unique challenges.

MBA 2020 Tech All-Star Rick Triola: The Crusade for Remote Online Notarization

One of the most remarkable mortgage technology developments in the past couple of years has been emergence of Remote Online Notarization as standard operating procedure. And the industry has Rick Triola to thank for that.

Mortgage Vendor News & Views with Scott Roller

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. The theme for today’s article is vendor innovations that are driving speed, quality and cost saves – a select few vendors that really don’t look much like their contemporaries.

Andrew Foster, Kelly Hamill: First Aid–Paycheck Protection Program Begins

The $2 trillion CARES Act bill is designed in part to provide liquidity to small businesses—including hard hit hotels—who will turn to the program first to cover costs such as payroll, utilities and interest on debt payments. Commercial real estate borrowers, tenants and their employees are prime candidates to apply for the program and many of MBA’s member banks will be instrumental in getting this $350 billion of relief to small businesses and their employees in communities across the country through their SBA lending programs.

Mortgage Applications Down in MBA Weekly Survey

Mortgage application activity took a hit last week as the housing market continued to struggle with the effects of the coronavirus pandemic, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending April 3.

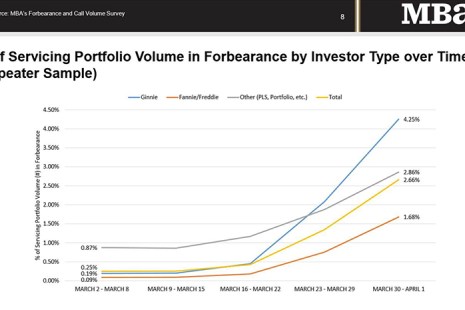

MBA Survey Shows Spikes in Loan Forbearance, Servicer Call Volumes

New survey findings from the Mortgage Bankers Association highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

MBA Takes Issue with Calabria’s Downplay of Need for Servicer Liquidity Facility

The Mortgage Bankers Association called “troubling” comments by Federal Housing Finance Agency Director Mark Calabria in which he dismissed the immediate need for a federally backed liquidity facility to assist mortgage servicers with forbearance efforts resulting from the coronavirus pandemic.

MBA Takes Issue with Calabria’s Downplay of Need for Servicer Liquidity Facility

The Mortgage Bankers Association called “troubling” comments by Federal Housing Finance Agency Director Mark Calabria in which he dismissed the immediate need for a federally backed liquidity facility to assist mortgage servicers with forbearance efforts resulting from the coronavirus pandemic.