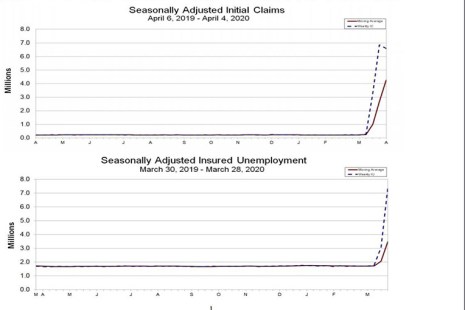

Nearly 6.6 million Americans filed new applications for unemployment benefits during the first week of April, the Labor Department reported yesterday, bringing the total number over the past three weeks to nearly 17 million.

Category: News and Trends

MBA Asks Small Business Administration to Relax Eligibility Rules for PPP Loans

The Mortgage Bankers Association, in a letter this week to the Treasury Department and the Small Business Administration, asked SBA to relax a part of its eligibility rule so that small independent mortgage banks can qualify for loans under Section 7(a) of the recently approved Paycheck Protection Program.

Fed Announces Additional $2.3 Trillion in Government Loan Facilities

The Federal Reserve yesterday announced a dramatic increase to the scale and scope of its mortgage-backed securities purchases, providing up to $2.3 trillion in new loans to support the economy to bolster the ability of state and local governments to deliver services during the coronavirus pandemic.

Fed Announces Additional $2.3 Trillion in Government Loan Facilities

The Federal Reserve this morning announced a dramatic increase to the scale and scope of its mortgage-backed securities purchases, providing up to $2.3 trillion in new loans to support the economy to bolster the ability of state and local governments to deliver services during the coronavirus pandemic.

Mortgage Vendor News & Views with Scott Roller

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. The theme for today’s article is vendor innovations that are driving speed, quality and cost saves – a select few vendors that really don’t look much like their contemporaries.

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

Nearly all companies have engaged in some form of business continuity planning. Generally, this exercise centers around developing contingency plans for maintaining normal operations in the face of a natural disaster or IT outage.

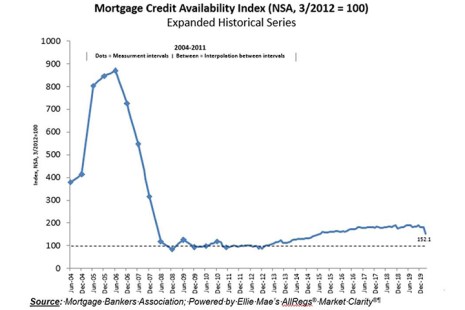

March Mortgage Credit Availability Falls to 5-Year Low

Mortgage credit availability decreased in March to its lowest level since June 2015, according to the Mortgage Bankers Association’s monthly Mortgage Credit Availability Index.

Senators Up Pressure on Administration to Provide Liquidity Facility

A bipartisan group of senators joined the Mortgage Bankers Association in raising concerns with the Trump Administration to provide urgent action to avoid a critical strain on liquidity for certain home mortgage servicers.

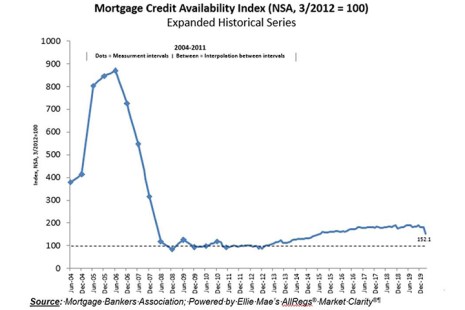

March Mortgage Credit Availability Falls to 5-Year Low

Mortgage credit availability decreased in March to its lowest level since June 2015, according to the Mortgage Bankers Association’s monthly Mortgage Credit Availability Index.

Hispanic Homeownership Up for 5th Straight Year

The National Association of Hispanic Real Estate Professionals released the 2019 State of Hispanic Homeownership Report, noting the Hispanic homeownership rate increased for the fifth consecutive year.