At a time when the world is dealing with COVID-19—economic, political, social, medical, personal and even spiritual—it is up to financial services organization leadership to look forward to the lasting impacts on banking and finance. Innovation breadth during times of great crisis will not be challenged, and the operating result will be a very foreign landscape to those anticipating minimal post-crisis adjustments.

Category: News and Trends

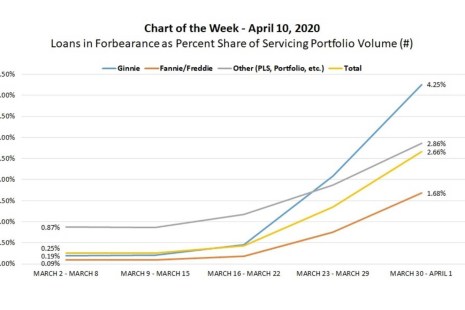

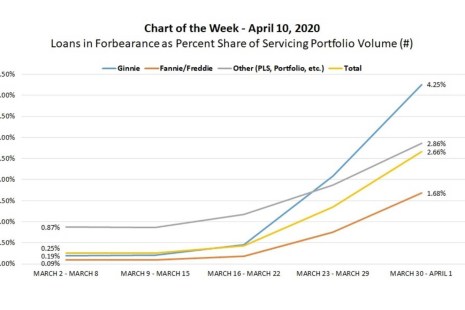

MBA Chart of the Week: Loans in Forbearance as Percent Share of Servicing Portfolios

New survey findings released by MBA this week highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).

MBA Advocacy Update

MBA President and CEO Bob Broeksmit, CMB, issued a statement responding to FHFA Director Mark Calabria’s comments dismissing the need at this time for a federally backed liquidity facility to assist mortgage servicers during the COVID-19 pandemic. MBA continues to advocate for the industry to help MBA members address the financing needs of their customers during the ongoing pandemic, and we will provide updates as they become available.

Ginnie Mae Implements Broad-Based Servicer Liquidity Facility; Initial Deadline Today

Late Friday, Ginnie Mae issued All Participants Memorandum 20-03 (APM 20-03), which expands its Issuer assistance programs to current circumstances stemming from the coronavirus pandemic. The APM introduces a new version of its existing Pass-Through Assistance Program for use by issuers facing a temporary liquidity shortfall directly attributable to the COVID-19 National Emergency.

MBA Advocacy Update

On Tuesday, MBA President and CEO Bob Broeksmit, CMB, issued a statement responding to FHFA Director Mark Calabria’s comments dismissing the need at this time for a federally backed liquidity facility to assist mortgage servicers during the COVID-19 pandemic. MBA continues to advocate for the industry to help MBA members address the financing needs of their customers during the ongoing pandemic, and we will provide updates as they become available.

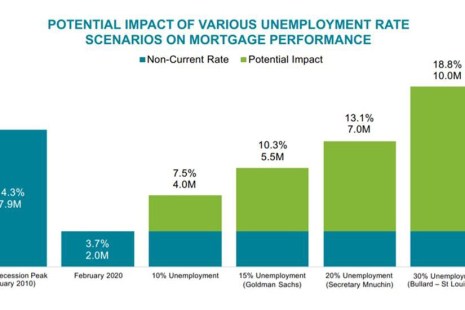

Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests

Leading up to the coronavirus outbreak, said Black Knight, Jacksonville, Fla., the vast majority of mortgage performance metrics were at or near record levels. Now, says Black Knight Data & Analytics President Ben Graboske, the mortgage market has been turned upside down.

MBA Opens Doors Foundation Sees Increase in Grant Applications

The MBA Opens Doors Foundation, which helps families around the country stay in their homes while a child is being treated for a critical illness or injury, is seeing an increase in grant applications from families in need.

Coronavirus Undermines CRE Market Momentum in Preliminary Q1 Data

Boxwood Means, Stamford Conn., said fallout from the coronavirus pandemic is becoming apparent in commercial real estate market fundamentals.

Dealmaker: Walker & Dunlop Provides $340 Million Acquisition Financing for Cortland REIT

Walker & Dunlop Inc., Bethesda, Md., structured $340 million in financing for Cortland’s acquisition of PURE Multi-Family REIT.

MBA Chart of the Week: Loans in Forbearance as Percent Share of Servicing Portfolios

New survey findings released by MBA this week highlight the unprecedented, widespread mortgage forbearance already requested by borrowers affected by the spread of the coronavirus (COVID-19).