Last week, the Mortgage Bankers Association made headlines—not just in MBA NewsLink but across the news spectrum—when it reacted strongly to Federal Housing Finance Agency Director Mark Calabria’s indifference to the need for a federally based liquidity facility for mortgage servicers resulting from economic fallout from the coronavirus pandemic.

Category: News and Trends

March New Home Purchase Mortgage Applications Up

Mortgage Bankers Association Builder Applications Survey data showed mortgage applications for new home purchases increased by 14 percent in March from February and by 21.2 percent from a year ago, unadjusted.

Groundswell of Support Builds for Federal Liquidity Facility

Last week, the Mortgage Bankers Association made headlines—not just in MBA NewsLink but across the news spectrum—when it reacted strongly to Federal Housing Finance Agency Director Mark Calabria’s indifference to the need for a federally based liquidity facility for mortgage servicers resulting from economic fallout from the coronavirus pandemic. Now, momentum in Washington is building.

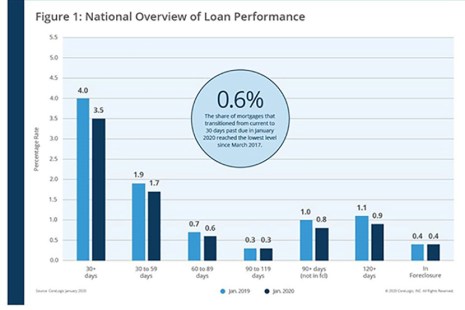

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

CoreLogic: Annual Delinquency Rates Fall for 25th Consecutive Month

CoreLogic, Irvine, Calif., reported 3.5% of mortgages in some stage of delinquency in January, an 0.5 percentage point decline in the overall delinquency rate from a year ago.

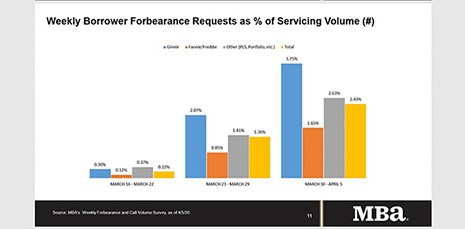

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

MBA Survey: Share of Mortgage Loans in Forbearance Continues to Climb

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans in forbearance jumped from 2.73% to 3.74% during the week of March 30 to April 5.

MBA Opens Doors Foundation Sees Increase in Grant Applications

MBA members are finding creative ways to support Opens Doors, including selection of Opens Doors as the beneficiary of the Mortgage 2020 conference taking place virtually on April 15 and 16.

Michael Steer: Coronavirus Highlights Need for Pandemic Planning

Nearly all companies have engaged in some form of business continuity planning. Generally, this exercise centers around developing contingency plans for maintaining normal operations in the face of a natural disaster or IT outage. However, with concerns surrounding coronavirus sending shockwaves throughout the U.S. and global economies, mortgage companies would be well advised to add pandemics to their list of events that could disrupt normal operations, as this specific type of incident poses unique challenges.

Jennifer Henry: In an Uncertain Market, Servicers Are Leveraging Data, Technology to Drive Efficiency

While the falling home loan rates mean a booming business for the mortgage industry and a sign the housing market may help the U.S. economy avoid a true recession, it could also pose a challenge for those trying to process the influx of applications and requests. The digital mortgage servicing journey must focus on streamlining the process through technology and data-enabled solutions.