In 2020, it is a pandemic virus altering global industries, supply chains and consumer interactions—what follows will be a “next normal” promising a post Great Depression rewriting of commerce. It will lead many consumers, businesses, politicians and pundits to ask, “Are Bankers Necessary?”

Category: News and Trends

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

As mortgage lenders shift focus from production to portfolio management in response to COVID-19, industry shifts are occurring alongside the inevitable reallocation of lending operation resources.

Tools for a Construction Lender’s Toolbox in the COVID-19 Era

While lenders are rightfully reluctant to take over a distressed project, they would still be wise to remain prepared in the event they are left with no other choice. Lenders should consider the following tips in order to remain ready to take over a failing project.

MBA Launches Consumer Ad Campaign

The Mortgage Bankers Association this week launched a digital advertising campaign designed to help consumers facing financial challenges as a result of the COVID-19 pandemic and show how the mortgage industry is helping consumers through the coronavirus pandemic.

MISMO Launches Initiative to Apply Digital Mortgage Standards to Loan Modification Process

MISMO, the Mortgage Industry Standards Maintenance Organization, seeks industry participants to join its initiative of applying digital mortgage standards, guidelines and best practices to the loan modification process.

People in the News

Homespire Mortgage, Gaithersburg, Md., announced Shondra B. Jenkins joined its team as Director of Philanthropy and Community Engagement, to further develop and enhance its corporate social responsibility programs and outreach.

Industry Briefs

IndiSoft, Columbia, Md., launched The Homeowner Connect to help servicers communicate effectively with borrowers who need loss mitigation help during the COVID-19 crisis.

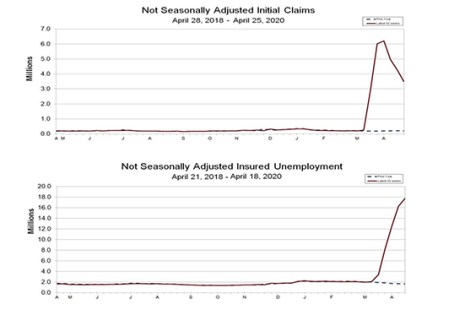

Spring Initial Unemployment Claims Top 30 Million

Americans filed 3.8 million new unemployment claims last week, the Labor Department reported yesterday, bringing the six-week total to more than 30 million—nearly one-fifth of the entire U.S. workforce.

Homebuyers Confront Credit Crunch as Coronavirus Puts Lenders on Edge

Nearly half of all Americans financed their home purchases with down payments of less than 20% last year, according to a new analysis by Redfin, Seattle.

Fed Says ‘Full Range of Tools’ Will Support Economy During ‘Challenging Time’

The Federal Open Market Committee yesterday said it is committed to using its “full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.”