Necessity is the mother of all invention, so the saying goes. No, not exactly true here. RON was already being deployed in pockets across the industry pre-coronavirus. Therefore, its more appropriate to proclaim, “perplexing problems produce instant popularity where past procrastination persisted.” Said more plainly – nothing is more white-hot than RON right now, and everyone suddenly cannot live without it. Demand far-outstrips supply by a factor too large to contemplate.

Category: News and Trends

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.

MBA Premier Member Profile: DataVerify

(One in a continuing series of profiles of Premier Members of the Mortgage Bankers Association.)

MBA May 19 Online State of the Industry Conference Adapts to a Changing World

There is nothing quite like attending a Mortgage Bankers Association conference in person. But with the entire country still dealing with the effects of the coronavirus pandemic, that on-site experience—for now—has to give way to the safety of your home. And MBA says it’s ready for you.

Pandemic Slows Real Estate Market

Clever Real Estate, St. Louis, Mo., found a slowing real estate market as homeowners planning to sell begin to pull homes off the market and potential buyers start holding off due to the pandemic.

Survey: More than Half of Mortgage, Auto Borrowers Concerned About Making Upcoming Payments

Bankrate.com, New York, said more than half of mortgage and auto loan borrowers (54% of each) are concerned about their ability to make their payments over the next three months.

Fitch: Coronavirus to Drive More ‘Outside-the-Box’ Appraisals in RMBS

Fitch Ratings, New York, said traditional “full” pre-close home appraisals, viewed to be best practice, are becoming less common in the mortgage origination process as homes are more difficult to access during the coronavirus outbreak.

Fannie Mae: COVID-19 Pushes Consumer Confidence in Housing to Lowest Level Since 2011

After falling by nearly 12 points last month, the Fannie Mae Home Purchase Sentiment Index decreased by nearly 18 more points in April to 63.0, its lowest reading since November 2011.

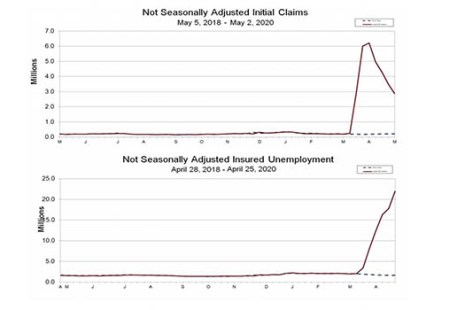

Coronavirus-Related Initial Claims Top 33.5 Million

The Labor Department yesterday reported an additional 3.17 million initial unemployment claims filed the week ending May 2, bringing total claims filed over the past seven weeks to 33.5 million.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.