MBA continues to advocate for the industry to help MBA members address the financing needs of their customers during the ongoing pandemic, and will provide updates as they become available. Several updates pertaining to COVID-19, along with other industry activities, are included in this week’s communication.

Category: News and Trends

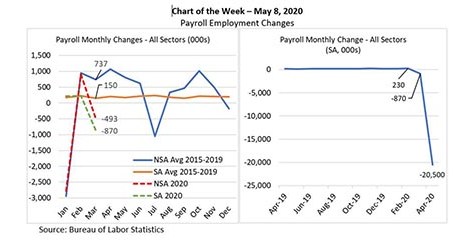

MBA Chart of the Week: Payroll Employment Changes

This week’s MBA Chart of the Week focuses on Friday’s grave employment report from the Bureau of Labor Statistics. The COVID-19 crisis has hit employment and household income in an unprecedented and accelerated fashion.

MBA Education Path to Diversity Scholar Profile: Jina Choi

Jina Choi is Vice President of Enterprise Innovation with loandepot.com

Scott Roller: Remote Online Notarization – Navigating the Icebergs

Necessity is the mother of all invention, so the saying goes. No, not exactly true here. RON was already being deployed in pockets across the industry pre-coronavirus. Therefore, its more appropriate to proclaim, “perplexing problems produce instant popularity where past procrastination persisted.” Said more plainly – nothing is more white-hot than RON right now, and everyone suddenly cannot live without it. Demand far-outstrips supply by a factor too large to contemplate.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.

The Week Ahead

Good morning! Welcome to another Monday, Week 10 of the Coronapacolypse. To all of you out there: thank you again for what you are doing. Stay healthy and safe.

MBA Advocacy Update

MBA continues to advocate for the industry to help MBA members address the financing needs of their customers during the ongoing pandemic, and will provide updates as they become available. Several updates pertaining to COVID-19, along with other industry activities, are included in this week’s communication.

MBA Chart of the Week: Payroll Employment Changes

This week’s MBA Chart of the Week focuses on Friday’s grave employment report from the Bureau of Labor Statistics. The COVID-19 crisis has hit employment and household income in an unprecedented and accelerated fashion.

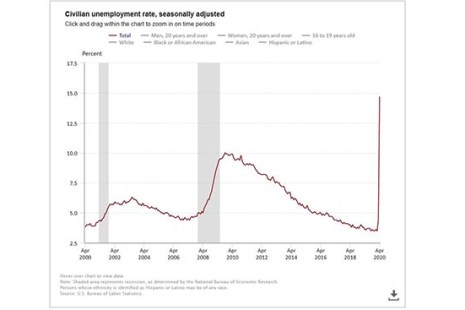

Labor Dept. Reports 20.5 Million April Job Losses; Unemployment Rate Jumps to 14.7%

One of the worst weeks in U.S. economic history ended Friday with the Bureau of Labor Statistics reporting a staggering 20.5 million jobs lost in April and the unemployment rate jumping to its highest level since the Great Depression.

MBA Education Path to Diversity Scholar Profile: Jina Choi

Jina Choi is Vice President of Enterprise Innovation with loandepot.com