Jina Choi is Vice President of Enterprise Innovation with loandepot.com

Category: News and Trends

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.

Industry Briefs

Essent Guaranty Inc., Radnor, Pa., and Cloudvirga, Irvine, Calif., announced an integration in which Cloudvirga will offer Essent’s products and services.

Senate Approves Montgomery HUD Nomination; Dana Wade FHA Nomination on Tap Today

It seemed like it took forever—and in political terms, seven months feels like forever—but Brian Montgomery is finally, officially, HUD Deputy Secretary.

Multifamily Market Musings: A Q&A With PGIM’s Mike McRoberts

MBA NewsLink interviewed PGIM Real Estate Finance Managing Director Mike McRoberts, who serves as Chairman of the firm’s Agency platform.

MAA Action Week Now ‘Month of MAA’

The Mortgage Action Alliance, the Mortgage Bankers Association’s free grassroots advocacy network, extended its fifth annual Action Week to the end of the month, through May, following a successful campaign that has seen its membership nearly double since February.

Housing Market Shows Early Signs of Recovery, Even Where COVID-19 Has Not Peaked

Redfin, Seattle, said new listings and home sales are seeing early signs of recovery in U.S. housing market, even as some cities struggle to flatten the coronavirus curve.

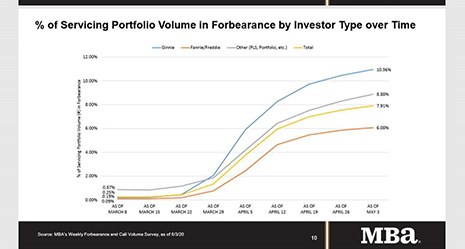

MBA: Share of Mortgage Loans in Forbearance Increases to 7.91%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased from 7.54% of servicers’ portfolio volume in the prior week to 7.91% as of May 3. MBA now estimates 4 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.91%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased from 7.54% of servicers’ portfolio volume in the prior week to 7.91% as of May 3. MBA now estimates 4 million homeowners are now in forbearance plans.

MBA Premier Member Profile: Richey May

Richey May, Englewood, Colo., is an accounting and business consulting firm, focused on the mortgage banking industry. Our diverse offerings include Audit, Tax, Accounting, Business Advisory and Technology Consulting. Founded in 1985, our specialized approach allows us to serve our clients at a high level, with many service leaders holding previous experience at mortgage companies.