Paper promissory notes have long been the mortgage industry standard. But should they be? The electronic equivalent, eNotes, are quickly rising in popularity; over 124,000 were filed in 2019, a huge jump from the 18,000 filed in 2018 and 5,000 in 2017. It’s not hard to see why they’re so in demand —eNotes are faster, cheaper and more secure.

Category: News and Trends

MBA Education Path to Diversity Scholar Profile: Austin Miller

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Abhinav Asthana: The Changing Landscape of Customer Acquisition & Engagement in the Lending Industry

Creating frictionless experiences is imperative to customer-facing businesses, and reducing friction is now a core driver of competitive differentiation. Lending organizations are continuously thinking about how to attract and retain customers by offering consistently relevant, personalized, and frictionless experiences while taking nothing for granted.

Josh Friend: Engagement is Critical During Challenging Times

Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

John Walsh: Tax Service – A New Era

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

MBA Advocacy Update

Last week, the Federal Housing Finance Agency announced temporary guidance from the GSEs to improve access to credit for borrowers who previously had entered forbearance. FHFA also released its highly anticipated proposal outlining a new capital framework for Fannie Mae and Freddie Mac.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.

Private Capital Conversation: A Q&A with ACRES Capital CEO Mark Fogel

MBA NewsLink interviewed ACRES Capital CEO Mark Fogel about the alternative lending landscape.

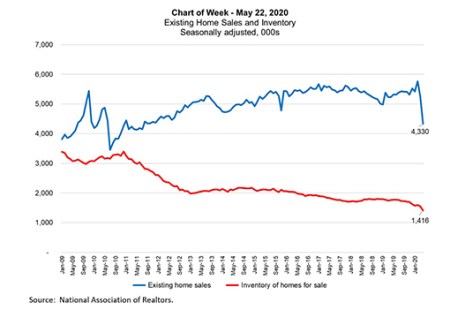

MBA Chart of the Week: Existing Home Sales and Inventory

Existing home sales plunged in April, as much of the U.S. economy and housing market bore the brunt of the COVID-19 pandemic’s social distancing and closures. There was an 18 percent drop in the seasonally adjusted, annualized pace of home sales, the largest single month decline since July 2010.