(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Category: News and Trends

‘Zombie’ Property Stats Hold Steady Amid Foreclosure Moratorium

ATTOM Data Solutions, Irvine, Calif., said the percentage of “zombie” properties—vacant properties facing foreclosure—held steady in the second quarter as nationwide moratoria on foreclosures kept activity to a minimum.

People in the News

ClearBlu Capital Group, Bellevue, Wash., appointed Vionna Adams as an advisor. She will play a critical role assisting in real estate planning, project management, civil engineering and other advisory services.

Dealmaker: Cushman & Wakefield Arranges $59M Office Sale

Cushman & Wakefield, Chicago, arranged the $58.5 million sale of a newly constructed Class A office building in Charlotte, N.C.

Industry Briefs

Black Knight, Jacksonville, Fla., said its McDash Flash Forbearance Tracker, as of May 19, reported 4.75 million homeowners – or 9.0% of all mortgages – have entered into COVID-19 mortgage forbearance plans. Active forbearance volumes increased by just 93,000 over the past week, a more than 70% decline from the 325,000 from the first week of May.

Office Employees Value Flexibility in COVID-19 Era

U.S. employees are re-examining their relationship with their offices due to COVID-19, said CBRE Hana, New York.

Andrew Foster: Mezzanine Market Musings

The commercial real estate mezzanine loan market is ripe with interesting market developments this year.

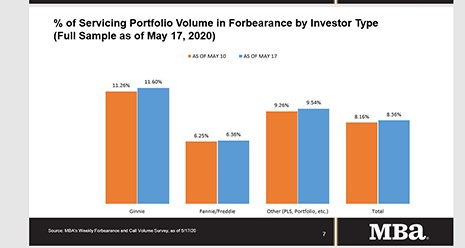

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

John Walsh: Tax Service – A New Era

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.

Improving the Loan Process With eNotes: A Game Changer for Risk Reduction, Processing Speed and Overall Efficiency

Paper promissory notes have long been the mortgage industry standard. But should they be? The electronic equivalent, eNotes, are quickly rising in popularity; over 124,000 were filed in 2019, a huge jump from the 18,000 filed in 2018 and 5,000 in 2017. It’s not hard to see why they’re so in demand —eNotes are faster, cheaper and more secure.