Fannie Mae, Washington, D.C., and Freddie Mac, McLean, Va., announced yesterday they will issue requests for proposals to hire an underwriting financial advisor to assist in developing and implementing a plan for recapitalizing and “responsibly ending” their conservatorship.

Category: News and Trends

Home Builder Confidence Rebounds from Historic April Drop

After suffering the largest single-month decline in its history in April, the National Association of Home Builders/Wells Fargo Housing Market Index rebounded in May, sort of.

MISMO Releases Updated Industry Loan Application Dataset

MISMO®, the mortgage industry standards organization, announced it updated the Industry Loan Application Dataset (iLAD), the modernized dataset for exchanging loan application data, to “Candidate Recommendation” status.

Global CRE Activity Drops

Commercial real estate transaction volume is slowing worldwide, reported Real Capital Analytics, New York.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

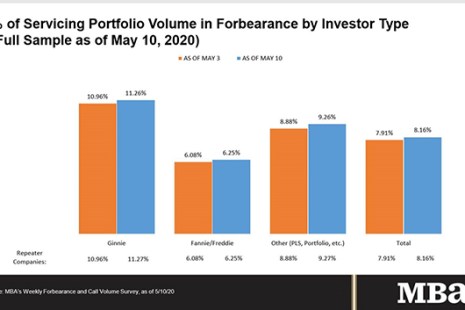

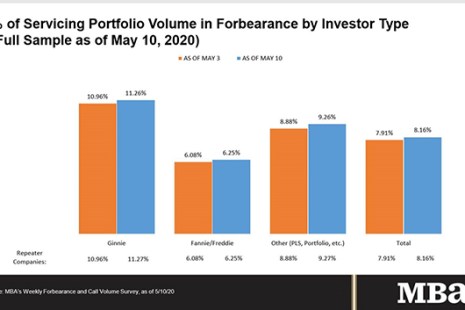

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

Dealmaker: Electra Capital Provides $10M in Equity Investments

Electra Capital, Lake Park, Fla., closed nearly $10 million in preferred equity investments for two Texas multifamily communities. In College Station, Electra made a $4 million, 36-month preferred equity investment …

MBA, Trade Groups Ask SEC to Amend Reg AB Disclosure Requirements

The Mortgage Bankers Association and other industry trade groups sent a letter yesterday to the Securities and Exchange Commission, asking it to consider amendments to Reg AB II disclosure requirements that will help to restore the registered segment of the private-label securities market.

Sponsored Content: Intelligent Valuation Portal — Your Rules, Your Evolution

While regulations, state law, and the definition of “essential business” change at a seemingly daily rate, the housing industry is caught in an unpredictable moment of waiting. In response, Connexions – a bank-grade, SaaS financial valuation company – has introduced a solution to help lenders operate effectively and responsibly.

House Passes $3 Trillion COVID-19 Relief Package; MBA Letter Details Industry Priorities

The House on Friday passed a massive $3 trillion pandemic relief bill on Friday that includes several key housing provisions advocated by the Mortgage Bankers Association.