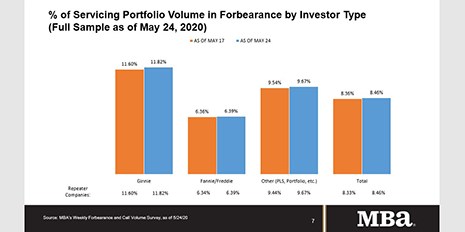

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

Category: News and Trends

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

(#MBALive) C-Suite Perspectives: How COVID-19 Has Changed Business Strategies

The economy might be teetering; and the COVID-19 pandemic hasn’t yet shown clear signs of subsiding. But thanks to technology and aggressive business strategies, the mortgage industry is showing remarkable resilience—and uncharacteristic innovation.

(#MBALive) Bob Broeksmit, CMB: ‘Great Challenge, Great Change’

(Prepared remarks by Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, at today’s MBA Live: Tech Solutions Conference.)

(#MBALive) Bob Broeksmit, CMB: ‘Great Challenge, Great Change’

(Prepared remarks by Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, at today’s MBA Live: Tech Solutions Conference.)

Sponsored Content: Intelligent Valuation Portal — Your Rules, Your Evolution

Learn how the Connexions Intelligent Valuation Portal can help you excel in times of change.

Distressed Debt Monitor: Q&A With SitusAMC’s Tim Mazzetti, CMB

MBA NewsLink interviewed Tim Mazzetti, CMB, who leads SitusAMC’s Servicing & Asset Management division.

MBA Advocacy Update: June 1, 2020

MBA remains engaged with key regulators, lawmakers, and stakeholders on top issues stemming from the COVID-19 pandemic. In response to member inquiries regarding the GSEs’ payment deferral options for borrowers in COVID-19 forbearance plans, MBA, along with counterparts from other national trade associations, developed FAQs following discussions with FHFA, Fannie Mae and Freddie Mac representatives.

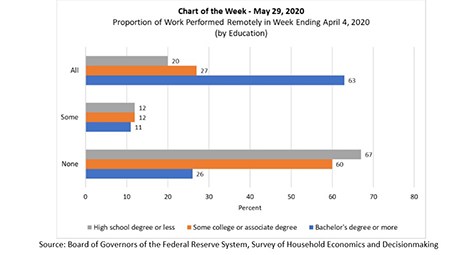

MBA Chart of the Week: Proportion of Work Being Performed Remotely

MBA’s Chart of the Week three weeks ago (May 8) focused on the U.S. Bureau of Labor Statistics’ bleak April report on employment conditions. We examined which industries and sectors have been hardest hit by the COVID-19 pandemic. This week, we continue our examination of the labor market using new survey data released by the Federal Reserve Board, and examine, by education level, how many people were able to work from home as the crisis deepened in early April.

Brent Chandler: Timely Employment Verification Pivotal to Mortgage, Other Consumer Lending Risk Management

Mortgage bankers and consumer lenders of every stripe have their plates full right now, so some may have missed a significant development or not had the bandwidth to consider its implications. One of America’s primary investors in loans to consumers has lost confidence in automated systems used for verifying loan applicants’ current employment status, accelerating an already-in-motion shift in how borrowers’ ability to repay needs to be assessed.