Learn how the Connexions Intelligent Valuation Portal can help you excel in times of change.

Category: News and Trends

Andrew Foster: Travel Nosedive Knocks Hospitality Industry

COVID-19 has impacted the entire United States and commercial real estate is no exception; however, no property type is quicker to experience the impacts of a downturn than lodging, where rental rates reset daily.

MISMO to Charge 75-Cent Fee on MERS-Registered Loans to Fund Initiatives

The Mortgage Bankers Association, MISMO and Mortgage Electronic Registration Systems (MERS) Board of Directors approved an $0.75 administrative fee for every new loan registered on the MERS system to help fund MISMO initiatives.

MBA Appoints Michael Briggs Senior Vice President and General Counsel

The Mortgage Bankers Association appointed Michael W. Briggs as Senior Vice President and General Counsel. He will serve as the association’s chief legal officer and is responsible for managing the legal affairs of the association and its subsidiaries and affiliates.

Dealmaker: Phillips Realty Capital Secures $29M for Virginia Office Asset

Phillips Realty Capital, Bethesda, Md., arranged $29 million in financing for Reston Metro Center One, a 124,000-square-foot office building in northern Virginia.

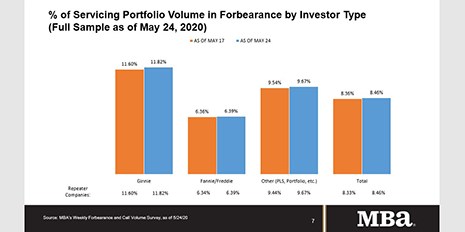

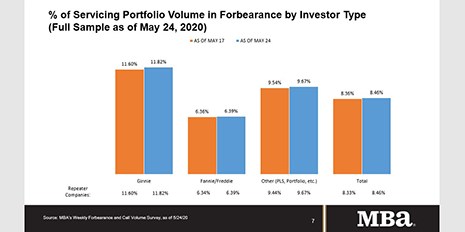

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

(#MBALive) C-Suite Perspectives: How COVID-19 Has Changed Business Strategies

The economy might be teetering; and the COVID-19 pandemic hasn’t yet shown clear signs of subsiding. But thanks to technology and aggressive business strategies, the mortgage industry is showing remarkable resilience—and uncharacteristic innovation.

(#MBALive) Bob Broeksmit, CMB: ‘Great Challenge, Great Change’

(Prepared remarks by Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, at today’s MBA Live: Tech Solutions Conference.)

(#MBALive) Bob Broeksmit, CMB: ‘Great Challenge, Great Change’

(Prepared remarks by Mortgage Bankers Association President & CEO Robert Broeksmit, CMB, at today’s MBA Live: Tech Solutions Conference.)