What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancelation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

Category: News and Trends

(#MBALive) Cybersecurity in a Remote-Work Environment

Security worries have grown as more people work remotely due to the pandemic, so it is more important than ever to consider security considerations for the teleworking environment.

ADP: May Private-Sector Employment Down 2.76 Million

In the first of three snapshots of employment data this week, ADP, Roseland, N.J., said private-sector employment fell by 2.76 million jobs in May.

Dealmaker: NorthMarq Secures $33M in Texas, Washington

NorthMarq, Minneapolis, secured $33.3 million for office and mixed-use assets in Texas and Washington.

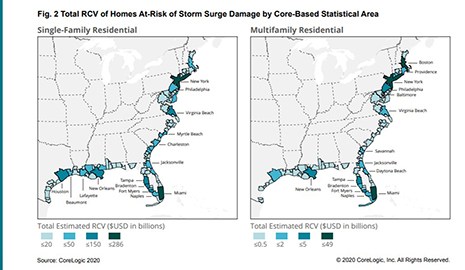

2020 Storm Surge Forecast Sees 7.4 Million Residences at Risk

Okay, just to recap: So far in 2020, we’ve had the COVID-19 pandemic; partial collapse of the U.S. economy; no spring home buying season; dam breaches in Michigan; one of the busiest tornado seasons this decade; and, God help us, “murder hornets.” Now it’s June, and the official start of North American hurricane season.

FHFA Publishes Final Rule on FHLBank Housing Goals

The Federal Housing Finance Agency yesterday published a final rule on the Federal Home Loan Banks’ Housing Goals, set to take effect in 2021.

Chris McEntee of ICE Mortgage Services on COVID-19 and Impetus for the Digital Mortgage Process

Chris McEntee is President of ICE Mortgage Services, Atlanta, the business unit responsible the Mortgage Electronic Registration System (MERS), which is now part of Intercontinental Exchange Inc. He serves as a Director of ICE Mortgage Services, the governing board of MERSCORP Holdings Inc. and chairs the Company’s Compliance, Governance and Risk Management Committee.

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications fell last week from one week earlier despite record low interest rates, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending May 29.

(#MBA Live) What to Think About Today, Tomorrow and the Next Phase

The coronavirus pandemic has placed enormous strains on the mortgage industry in general and its technology teams in particular.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancelation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.