Zillow, Seattle, said its analysis found more than $1.7 billion in rent and mortgage payments is owed each month by U.S. service-sector workers currently receiving unemployment benefits as a result of the coronavirus pandemic — payments that could be in jeopardy if expanded local and federal unemployment assistance fades or workers remain without incomes longer than expected.

Category: News and Trends

MBA, Trade Groups Urge HUD to Modify FHA Forbearance Indemnification Policy

Sixteen industry trade organizations joined the Mortgage Bankers Association in a letter this week to HUD, expressing concerns with a recently announced FHA policy requiring lenders to provide 20 percent indemnification of the original loan amount for up to two years in relation to borrowers who enter into forbearance due to COVID19-related hardship after closing and prior to FHA insuring their loan.

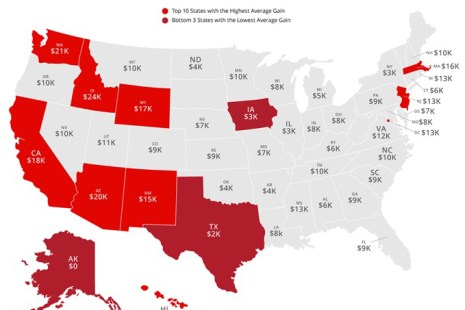

CoreLogic: Borrowers Gain $6 Trillion in Home Equity Since End of Great Recession

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages—representing 63% of all properties—have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since 2019.

FCRA and the CARES Act: Putting in Right Procedures Now, Reducing Volume of Litigation Later

Over the past 10 years, Fair Credit Reporting Act lawsuits have almost quadrupled from some 1,350 cases in 2010 to 5,000 in 2019. FCRA allows plaintiffs to recover attorney fees, which may explain the increase.

Dealmaker: NXT Capital Closes $46M Loan to Colorado Office Park

NXT Capital, Chicago, closed a $45.6 million loan to finance acquisition of Cherry Creek Plaza I & II, a two-building office park in Glendale, Colo.

Quote

“[Yesterday’s] announcement from the Federal Reserve is aligned with this reading of the economy: we might be getting better – but we are still far away from full employment – with risks ahead from a second wave of the pandemic and huge economic uncertainties. Monetary policymakers will therefore keep rates low for years to ensure a full recovery.”

–MBA Chief Economist Mike Fratantoni.

Mortgage Applications Bounce Back in MBA Weekly Survey

Mortgage applications increased from one week earlier as key interest rates held steady, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending June 5.

Industry Briefs (June 10, 2020)

HUD issued a news release this month marking National Homeownership Month, recognizing the importance of homeownership and its impact upon the lives of American families, local neighborhoods and the national economy.

Clint Salisbury: For eClosing Success, Fine Tune Implementation

Our industry’s reliance on technology is deepening every day as never-before-experienced demands emerge. For example, in a world that demands distance, the ability to perform an eClosing has evolved from nice-to-have to “essential worker” status. Lenders entering this uncharted territory may find setting internal and external eClosing protocols daunting. Whether you adopt a hybrid process or go fully digital, there are best practices consistent for each option that can ensure your successful eClosing implementation.

Mark P. Dangelo: The Demise of the Contact Banker

Banking was a “contact” industry—prior to the Great Recession. With the loss of 12,000 branches in the past decade and consumers now doing over 90% of their transactions digitally, public health implications and social unrest, if sustained, may be the catalysts for closing many more branches by 2022.