Banking was a “contact” industry—prior to the Great Recession. With the loss of 12,000 branches in the past decade and consumers now doing over 90% of their transactions digitally, public health implications and social unrest, if sustained, may be the catalysts for closing many more branches by 2022.

Category: News and Trends

Clint Salisbury: For eClosing Success, Fine Tune Implementation

Our industry’s reliance on technology is deepening every day as never-before-experienced demands emerge. For example, in a world that demands distance, the ability to perform an eClosing has evolved from nice-to-have to “essential worker” status. Lenders entering this uncharted territory may find setting internal and external eClosing protocols daunting. Whether you adopt a hybrid process or go fully digital, there are best practices consistent for each option that can ensure your successful eClosing implementation.

MBA Education Path to Diversity Scholar Profile: Malik Wilkes

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

MBA, Trade Groups Oppose ‘Fundamentally Flawed’ California COVID Relief Bill

The Mortgage Bankers Association and nearly two dozen other industry trade groups sent a letter this week to California legislators, strongly opposing as “fundamentally flawed” and “disruptive” a broad-brush bill aimed at assisting state residents experiencing financial difficulties amid the coronavirus pandemic.

Fannie Mae: Lenders’ Demand Expectations for Purchase Mortgages Down ‘Significantly;’ Refis ‘Strong and Stable’

The latest Fannie Mae Mortgage Lender Sentiment Survey found mortgage lenders’ profit margin outlook for the next three months fell slightly but remained positive due to strong reported refinance demand.

FHFA Extends GSE COVID-Related Loan Processing Flexibilities Through July

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 national emergency through at least July 31.

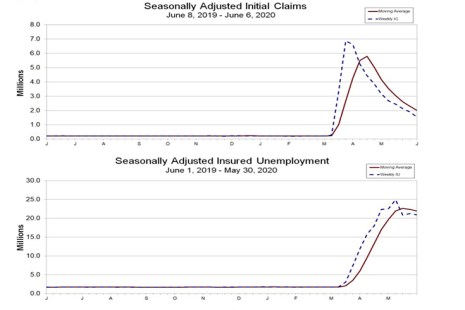

Americans File 1.54 Million More Initial Claims

More than 1.5 million Americans filed new claims for unemployment insurance during the first week of June, the Labor Department reported Thursday—the lowest level since the start of the coronavirus pandemic but still well above historic norms.

For Single Women, Minorities, Divergent Paths on Homeownership

Two reports show that homeownership opportunities for key segments of the economy—single women and minorities—continue to move in different directions.

Dealmaker: Fantini & Gorga Arranges $34M in Construction Financing, Equity

Fantini & Gorga, Boston, arranged $33.5 million in construction financing and equity for One Wall Street Residences, a planned 136-unit transit-oriented development in Attleboro, Mass.

Wells Fargo Securities on Retail’s Future

Measures taken to contain coronavirus harmed the retail sector, but the pandemic might re-shape retail in positive ways, said Wells Fargo Securities, Charlotte, N.C.