A divided Supreme Court on Monday ruled the current structure of the Consumer Financial Protection Bureau, with power resting with a single director, is unconstitutional, but stopped short of allowing the Trump Administration to dismantle the agency.

Category: News and Trends

1Q Apartment Investment Rises, Driven by Falling Mortgage Rates

Freddie Mac said its Apartment Investment Market Index rose 1.8 percent in the first quarter after declining modestly in late 2019.

Dealmaker: CBRE Closes $71M

CBRE, Los Angeles, closed $71.3 million in office and retail transactions in Scottsdale, Ariz.

MBA, Partners Launch CONVERGENCE Affordable Housing Initiative in Memphis

A year ago, the Mortgage Bankers Association launched a strategic initiative to help develop stronger and more effective affordable housing partnerships in both the policy and business arenas. Recently, MBA put that commitment to work in Memphis.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency on Monday announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

Quote

“The level of forbearance requests remains quite low as of mid-June. The rebound in the housing market is likely one of the factors that is providing confidence to both potential homebuyers and existing homeowners during these troubled times.”

–MBA Chief Economist Mike Fratantoni.

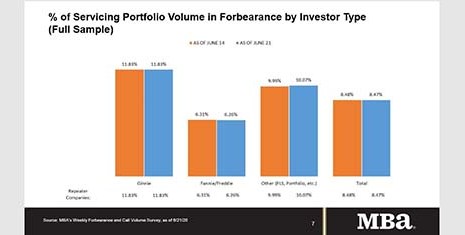

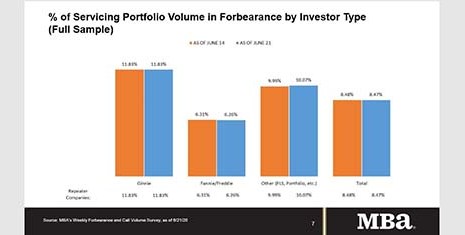

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

Industry Briefs June 30, 2020

Roostify, San Francisco, announced a partnership with Factual Data as part of an expansion that will allow loan officers to run borrower credit and view findings within the Roostify platform.

Keith Soura of Blend on the Future of APIs and MISMO

Keith Soura is a Platform Engineer with Blend, San Francisco, responsible for development of Blend’s core platforms, including APIs and event-driven architecture that power customer and partner integrations.