ACES Risk Management, Denver, released its quarterly ARMCO Mortgage QC Trends Report, showing critical defect rates improved from the fourth quarter to the first and in 2019 overall.

Category: News and Trends

STRATMOR: How Pandemic Reinforced ‘Three Immutable Laws’ of Economics

STRATMOR Group, Greenwood Village, Colo., said while the longer-term impact of the pandemic remains to be seen, the mortgage market has settled down, with most industry players appearing to have weathered the storm.

Ellie Mae: Refi Market Steady as Interest Rates Continue to Drop

Interest rates hit record lows last week—but they were already low in May, said Ellie Mae, Pleasanton, Calif., resulting in steady refinancing volume.

CBRE Forecasts Hotel Demand Recovery by Late 2022

After suffering the greatest performance declines in U.S. history, the nation’s hotels will likely benefit from a relatively rapid economic turnaround in 2021 and 2022, said CBRE Hotels, Atlanta.

MBA Education Path to Diversity Scholar Profile: Saket Nigam

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Dealmaker: Cushman & Wakefield Closes $54M in Industrial, Retail

Cushman & Wakefield, Chicago, brokered industrial and retail transactions totaling $53.6 million in California and New Jersey.

Sherwood Lawrence: Does the LO Have a Future in the Digital Mortgage World?

The digital mortgage revolution doesn’t take sides, but that doesn’t mean there won’t be casualties. The march toward efficient loan transactions will permanently redefine the roles of the mortgage lender and loan officer, radically transforming the entire production line of mortgage origination.

The Week Ahead

Good morning! Happy first week of summer, which promises a lot of activity—and a heads-up for anyone who uses the Mortgage Bankers Association’s website.

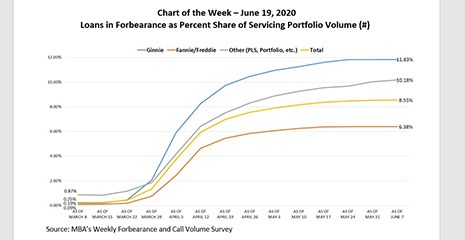

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

This week’s chart shows the course of the share of loans in forbearance by investor type over the past three months – from the earliest stages of the COVID-19 pandemic to the most recent reporting.

MBA Data Systems Updates to Take Place June 25-29

Beginning Thursday, June 25, the Mortgage Bankers Association will begin replacing its Association Management System, which will result in some disruptions for MBA members.