According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

Category: News and Trends

Technology Talk: Q&A with SS&C’s Bob Wright, CMB, CCMS

MBA NewsLink interviewed Bob Wright, CMB, CCMS,about SS&C Technologies’ work-from-home experience and his experience with Coronavirus.

ADP Reports 2.37 Million Increase in June Employment

Ahead of today’s employment report from the Labor Department, ADP, Roseland, N.J., said private sector employment increased by 2.37 million jobs from May to June.

Quote

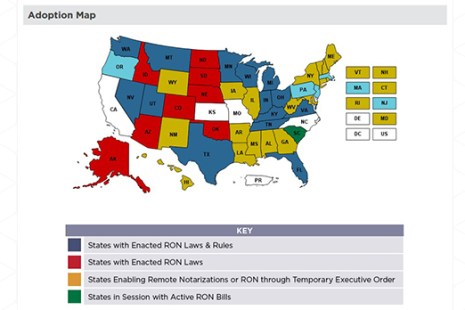

“Our concern was that with the emergency nature of the pandemic, states were executing orders that weren’t really secure and didn’t meet the minimum standards for RON through either the non-partisan Uniform Law Commission or the ALTA/MBA RON bill. What we were trying to do is give states a recourse, allowing for RIN and RON done in a way that was consistent with GSE guidelines and create legal certainty and increase both the insurability and salability for these loan products.”

–MBA Associate Director of State Government Affairs Kobie Pruitt, on an MBA/trade group-developed draft Remote Online Notarization Executive Order for states to use to enable RON during the coronavirus pandemic.

Millennial Homeownership ‘Delayed, Not Denied’

Despite the economic effects of the coronavirus pandemic, millennials appear poised to fuel a “Roaring ’20s” of homeownership demand, said First American Financial Corp., Santa Ana, Calif.

Dealmaker: Nashville’s Union Station Hotel Trades for $56M

Pebblebrook Hotel Trust, Bethesda, Md., sold the 125-room Union Station Hotel Nashville, Autograph Collection in Nashville for $56 million.

Distressed Debt Monitor: Special Situations in Commercial Real Estate

As economies reopen against a backdrop of decreased consumer demand and continued government relief, commercial real estate investors are grappling with a double-edged sword: defending certain existing challenged debt and equity positions on one hand and seeking new opportunities given shifted market dynamics.

People in the News July 2, 2020

LenderClose, Des Moines, Iowa, appointed Martina Schubert as chief technology officer, responsible for aligning technological vision with the company’s needs to positively impact current and future operations.

MBA, Trade Groups Draft Model Remote Notarization Executive Order

The Mortgage Bankers Association, the American Land Title Association and the National Association of Realtors have developed a model executive order for states to enable remote notarizations during coronavirus pandemic.

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.