Adherence to vendor management best practices needs to remain top of mind for lenders even when accelerating their digital mortgage tech selection and deployment process. Compliance with regulatory requirements and proper risk mitigation are not steps to be overlooked.

Category: News and Trends

People in the News July 7, 2020

LenderClose, Des Moines, Iowa, appointed Martina Schubert as chief technology officer, responsible for aligning technological vision with the company’s needs to positively impact current and future operations.

MBA Education Path to Diversity Scholar Profile: Candace Hargrave

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

MBA Advocacy Update

On Monday, the U.S. Supreme Court issued its decision in Seila Law LLC v. Consumer Financial Protection Bureau, holding that the Consumer Financial Protection Bureau’s single-director structure violates the Constitution’s separation of powers scheme while also ruling that the CFPB can continue to operate.

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

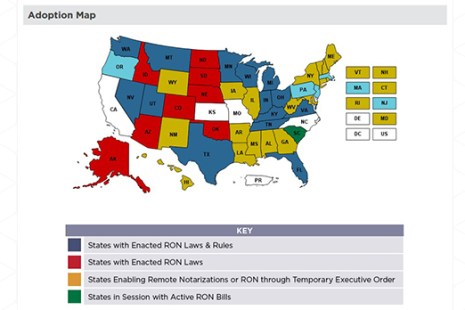

MBA, Trade Groups Draft Model Remote Notarization Executive Order

The Mortgage Bankers Association, the American Land Title Association and the National Association of Realtors have developed a model executive order for states to enable remote notarizations during coronavirus pandemic.

Aneeza Haleem: Can You Trust AI and Your BOT Workforce to Make the Best Decisions for Your Customers?

We have successfully tackled using AI in newer areas, such as tiered contextual responses, voice recognition, biometrics and natural language processing. The fuzziness increases in emerging areas of AI use, including one where it’s especially common in mortgage banking – customer engagement using sentiment analysis and advanced contextual cues.

CFPB Issues Proposed Rule on Reg Z Escrow Exemptions

The Consumer Financial Protection Bureau on Thursday issued a notice of proposed rulemaking that would amend Regulation Z to provide a new exemption available to certain insured depository institutions and insured credit unions from the requirement to establish escrow accounts for certain higher-priced mortgage loans.

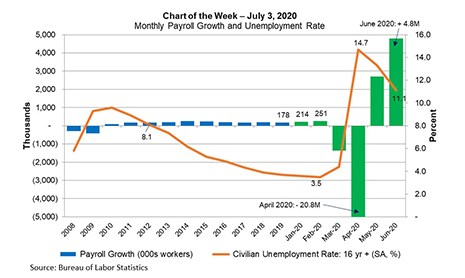

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The economy added a record 4.8 million jobs to nonfarm payrolls in June, bringing the cumulative increase in May and June to one-third of the sharp decreases in March and April. Similarly, the June unemployment rate, at 11.1%, was down 3.6% from its high in April, and labor force participation jumped by 0.7% to 61.5% (1.9% below its pre-coronavirus level in February). However, we are not yet out of the woods.

Michael Steer & Erin Harris: Accelerated Digital Mortgage Tech Strategies Must Also Include Sound Vendor Management

Adherence to vendor management best practices needs to remain top of mind for lenders even when accelerating their digital mortgage tech selection and deployment process. Compliance with regulatory requirements and proper risk mitigation are not steps to be overlooked.