LenderClose, Des Moines, Iowa, appointed Martina Schubert as chief technology officer, responsible for aligning technological vision with the company’s needs to positively impact current and future operations.

Category: News and Trends

Michael Steer & Erin Harris: Accelerated Digital Mortgage Tech Strategies Must Also Include Sound Vendor Management

Adherence to vendor management best practices needs to remain top of mind for lenders even when accelerating their digital mortgage tech selection and deployment process. Compliance with regulatory requirements and proper risk mitigation are not steps to be overlooked.

Quote

“It is critical that the Commission’s rules governing call-blocking practices protect consumers from the risk that they might not receive important, often time-sensitive, calls from health care providers, finance companies, banks, credit unions, other participants in the financial services marketplace, retailers and other legitimate businesses.”

–From an MBA/trade group letter to the FCC asking that final rules on robocalls and “spoofing” include safeguards for financial services providers conducting legitimate business.

MBA, Trade Groups Submit Recommendations to FCC on Robocall Draft Order

The Mortgage Bankers Association and nearly a dozen industry trade groups sent a letter this month to the Federal Communications Commission offering recommendations to improve an FCC draft order addressing robocalls and “spoofing.”

CRE Counselors: COVID-19, Economy Top Survey Concerns

The Counselors of Real Estate, Chicago, said the COVID-19 crisis will teach commercial real estate practitioners new lessons about priorities, resilience and demand.

Black Knight: Cash-Out Refinances Fall Despite Record-High Tappable Equity

Black Knight, Jacksonville, Fla., said homeowners’ tappable equity rose by 8% annually in the first quarter to a record-high $6.5 trillion.

Dealmaker: JLL Closes 20-Property Portfolio for $106M

JLL Capital Markets, Atlanta, finalized a 20-property Project-Based Section 8 portfolio sale totaling 1,763 units and $106 million across Georgia, North Carolina and South Carolina.

Industry Briefs July 7, 2020

CoreLogic, Irvine, Calif., launched OneHome, a virtual, collaborative platform for real estate agents and their clients looking to buy, sell or make improvements to a home. Following a launch with Ohio-based Yes-MLS, OneHome is expected to be nationally available by the end of 2020 to the more than 850,000 real estate agents in North America who currently use CoreLogic’s multiple listing platform.

Aneeza Haleem: Can You Trust AI and Your BOT Workforce to Make the Best Decisions for Your Customers?

We have successfully tackled using AI in newer areas, such as tiered contextual responses, voice recognition, biometrics and natural language processing. The fuzziness increases in emerging areas of AI use, including one where it’s especially common in mortgage banking – customer engagement using sentiment analysis and advanced contextual cues.

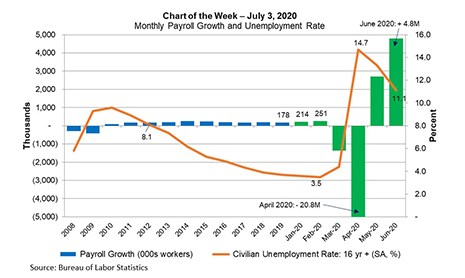

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The economy added a record 4.8 million jobs to nonfarm payrolls in June, bringing the cumulative increase in May and June to one-third of the sharp decreases in March and April. Similarly, the June unemployment rate, at 11.1%, was down 3.6% from its high in April, and labor force participation jumped by 0.7% to 61.5% (1.9% below its pre-coronavirus level in February). However, we are not yet out of the woods.