In a world of uncertainty, bankers, lenders and technology firms had grown accustom to traditional measures and approaches honed over decades of lessons learned. Today, the playbooks are gone, and we need to accept that consumers will not wait for us as we say the right things—but execute against a script that has been retired.

Category: News and Trends

Faith Schwartz: New Era Borne of Pandemic to Upend Mortgage Costs

As longtime industry participants, we at Housing Finance Strategies contend that the pandemic has created a revolutionary opportunity that we must seize and leverage so that the mortgage business can emerge with higher quality prospective products funded through a drastically reduced cost structure.

MBA Education Path to Diversity Scholar Profile: Sammy Ramirez

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Craig Riddell of LoanLogics on Digital Technologies

Craig Riddell is Executive Vice President and Chief Business Officer with LoanLogics, Trevose, Pa. He is responsible for establishing and developing ongoing relationships with LoanLogics’ largest enterprise clientele, as well as leading the company’s Sales, Marketing and Account Management functions.

Housing Finance Roundup: July 13, 2020

MBA NewsLink summarizes more than half a dozen new reports from Redfin; Zillow; First American Financial Corp.; Fitch Ratings; ATTOM Data Solutions; and Black Knight.

The Week Ahead

The Mortgage Bankers Association releases several reports this week, starting with its weekly Forbearance and Call Volume Report this afternoon at 4:00 p.m. ET. Look for a special edition of MBA NewsLink today to give you the latest info. MBA also releases its monthly Builder Applications Survey on Tuesday, July 14 (tentative) and its Weekly Applications Survey this Wednesday, July 15.

CRE Market Sentiment Plunges

CRE executives’ market sentiment “plunged as expected” in mid-2020, said RCLCO Real Estate Advisors, Washington, D.C.

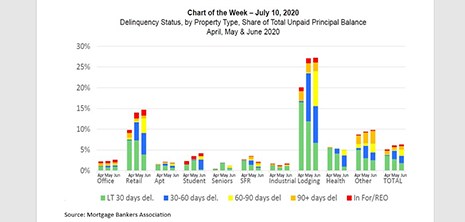

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

Dealmaker: Walker & Dunlop Closes $56M in Multifamily, Nursing Facility Transactions

Walker & Dunlop, Bethesda, Md., sold and financed The Moretti at Vulcan Park, a 135-unit apartment community in Birmingham, Ala.

Mark Dangelo: Beware—Watch This Space, Part One

In a world of uncertainty, bankers, lenders and technology firms had grown accustom to traditional measures and approaches honed over decades of lessons learned. Today, the playbooks are gone, and we need to accept that consumers will not wait for us as we say the right things—but execute against a script that has been retired.