Use this enclosed checklist to prepare for selling and servicing eMortgages with Fannie Mae.

The eMortgage team will work with you to gain Fannie Mae approval.

Use this enclosed checklist to prepare for selling and servicing eMortgages with Fannie Mae.

The eMortgage team will work with you to gain Fannie Mae approval.

In a world of uncertainty, bankers, lenders and technology firms had grown accustom to traditional measures and approaches honed over decades of lessons learned. Today, the playbooks are gone, and we need to accept that consumers will not wait for us as we say the right things—but execute against a script that has been retired.

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. Today we highlight three very unique tech vendors that help in attracting and retaining borrowers, while improving your customer care model via a variety of newer entrants in our service provider market.

Greater emphasis on corporate social responsibility and new technologies have improved global real estate transparency over the past two years, JLL and LaSalle reported.

The Mortgage Bankers Association, in a July 14 letter to House leadership, urged the House to approve key industry-supported provisions for FHA in the federal government’s fiscal 2021 proposed budget.

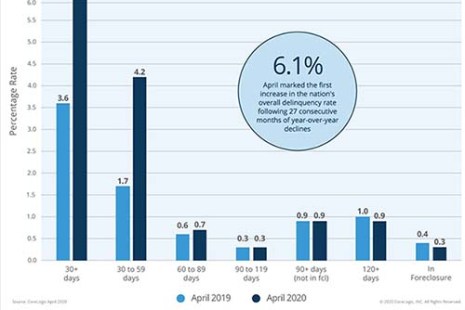

CoreLogic, Irvine, Calif., said April early stage mortgage delinquencies jumped to levels that exceeded even those during the Great Recession.

two years ago, mortgage industry advisory firm STRATMOR Group published data illuminating just how important it is for loan officers to attend their closings. We live in a very different world than we did two years ago, and while the nature of closings may have changed in 2020, the impact of the closing on the overall borrower experience has not.

The eMortgage Readiness Checklist outlines key steps toward adopting a digital mortgage process and will prepare you for selling and servicing eMortgages with Fannie Mae. Use it to assess readiness and track your progress.

“MBA has long been a proponent of adequate funding for staffing, project management and potential improvements that would allow the agency to better manage its operations and the risks associated with its Mutual Mortgage Insurance Fund.”

–MBA Senior Vice President of Legislative and Political Affairs Bill Killmer, in an MBA letter to House appropriators in support of the Fiscal 2021 T-HUD appropriations bill.

Mortgage applications increased for the second straight week as the 30-year fixed rate fell to yet another record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 10.