New home sales beat expectations again in June, HUD and the Census Bureau reported Friday, posting double-digit increases for the second straight month.

Category: News and Trends

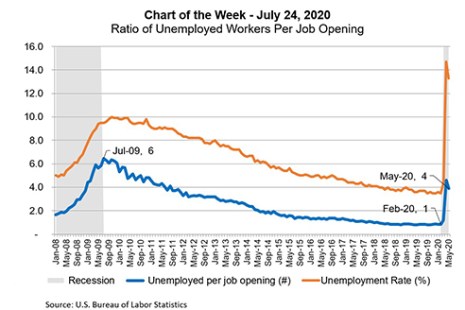

MBA Chart of the Week: Ratio of Unemployed Workers Per Job Opening

This week’s MBA Chart of the Week uses data from the U.S. Bureau of Labor Statistics to look at the ratio of the number of unemployed workers to job openings to highlight how the current recession is different than the recession in 2007-2009.

The Week Ahead

The Federal Open Market Committee holds its next Policy Meeting this Tuesday, July 28 and Wednesday, July 29. While Fed-watchers don’t expect the FOMC to take action on the federal funds rate—it’s already at zero—they will, as usual, go over the Wednesday statement with a fine-toothed editing pencil to gain insight on other steps to boost an uncertain economy amid the global coronavirus pandemic.

Dealmaker: JLL Arranges $51 Million for Data Center, Retail

JLL Capital Markets arranged $51.5 million in financing for a Massachusetts data center and retail centers in Philadelphia and the San Francisco Bay Area.

Chris Lewis: 3 Steps You Should Take Now to Get Ready for RON

Many of the industry’s efficiency experts have long argued that a digital mortgage can save all parties time and money. In the past, however, there were too many downstream issues that blocked the process from full-scale adoption. But with shelter in place, safer at home and social distancing all coming into play, the pandemic has led to a renewed push to get a completely digital mortgage as the new way to close all your loans.

MBA Advocacy Update

As Congress returned to begin working on the preliminary contours of another COVID-19 relief and response package, the Federal Housing Finance Agency proposed its 2021 housing goals for Fannie Mae and Freddie Mac, specifying both the single-family and multifamily mortgage purchase benchmarks for low-income borrowers or borrowers residing in low-income areas.

Quote

“Record-low mortgage rates and pent-up demand from the spring continue to be main drivers for the housing market this summer. New home sales picked up for the second straight month in June, in line with various other housing market indicators showing strong demand following the pandemic-induced low in April.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Kelly Hamill and Andrew Foster: Seniors Housing Spotlight

All property types have felt some effects from COVID-19, but seniors housing is a special case. It has seen a variety of impacts including in occupancy rates and expenses.

People in the News July 24, 2020

LRES Corp., Orange, Calif., named Tina Suihkonen as Senior Director of Commercial Services. She will lead LRES’ commercial default services division and provide nationwide commercial trustee and foreclosure services.

Fannie Mae: Explore How the Industry is Going Digital with eMortgages (July 24, 2020)

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.