LRES Corp., Orange, Calif., named Tina Suihkonen as Senior Director of Commercial Services. She will lead LRES’ commercial default services division and provide nationwide commercial trustee and foreclosure services.

Category: News and Trends

Dealmaker: Pulte Homes Buys Former San Mateo, Calif. Office Park for $106M

Pulte Homes, Atlanta, purchased an 11-acre former office park between San Francisco and Silicon Valley for $106 million.

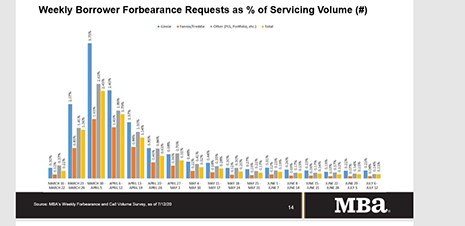

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Quote

“The pace of new forbearance requests remains quite low compared to earlier in the crisis, but we are watching carefully for any increases due to either the pick-up in COVID-19 cases or the cessation of enhanced unemployment insurance benefits at the end of this month.”

–MBA Chief Economist Mike Fratantoni.

Quote

“The pace of new forbearance requests remains quite low compared to earlier in the crisis, but we are watching carefully for any increases due to either the pick-up in COVID-19 cases or the cessation of enhanced unemployment insurance benefits at the end of this month.”

–MBA Chief Economist Mike Fratantoni.

MBA Advocacy Update

Last Thursday MBA asked HUD to withhold publication of its final disparate impact rule and to bring the housing, lending and civil rights communities together for renewed discussions about how to address the wide housing and wealth gaps faced by communities of color.

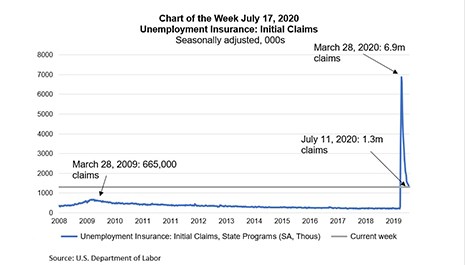

MBA Chart of the Week: Unemployment Insurance/Initial Claims

This week’s chart highlights initial unemployment claims data from the U.S. Department of Labor, portraying the speed and severity of the labor market’s deterioration during the COVID-19 pandemic, as businesses closed or transitioned to remote working arrangements.

MBA Education Path to Diversity Scholar Profile: Lakendra Turner

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Rick Triola: How to Avoid Leaving an Empty Seat at the Closing Table

two years ago, mortgage industry advisory firm STRATMOR Group published data illuminating just how important it is for loan officers to attend their closings. We live in a very different world than we did two years ago, and while the nature of closings may have changed in 2020, the impact of the closing on the overall borrower experience has not.

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.