Category: News and Trends

Fannie Mae: Explore How the Industry is Going Digital with eMortgages

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.

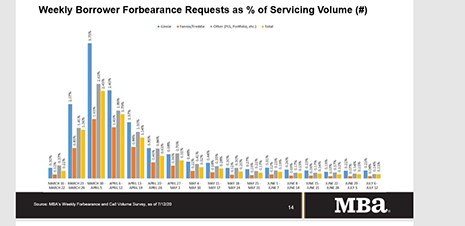

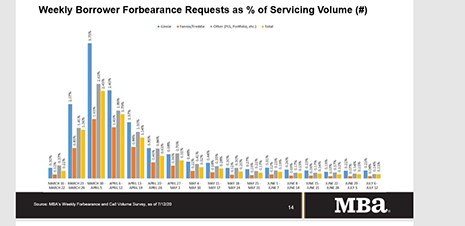

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

People in the News July 22, 2020

LRES Corp., Orange, Calif., named Tina Suihkonen as Senior Director of Commercial Services. She will lead LRES’ commercial default services division and provide nationwide commercial trustee and foreclosure services.

Brian Simons: The Modern Operating Model for Mortgage Lenders

In the last five years, lenders have made great strides with significant investments in best-in-class borrower experiences, navigating a plethora of new digital tools, all while adeptly navigating the ups and downs of the market. In my experience, unfortunately, most initiatives to cut costs and improve quality are short-lived or merely incremental. What I have found over my 25 years in this industry is that transformational growth only occurs when senior leadership commits itself to reevaluating their entire operating model.

MBA Education Path to Diversity Scholar Profile: Lakendra Turner

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.